Let us put forward a hypothetical situation that your insurance company should have already been to. A car accident happens to your customer, who registers an insurance claim and waits until the claim is processed. The experience seems nasty enough for the customer as it is: they don’t have any vehicles right now and need to repair or replace the car. Far worse, if they have to spend extra on medical care.

No wonder your customer may feel annoyed and disappointed by how slowly the insurer handles their claim. But what if you could reinvent your insurance business model by automating claims processing via machine learning (ML)?

Insurance claims processing automation with machine learning could bring lots of value to your organization. With less tedious paperwork and a reduced number of human-to-human interactions, you could deliver claims processing services faster to the customer and so improve your customer loyalty. Also, you can predict customer churn by using machine learning.

Read also: AI for Car Damage Detection

Why does claim automation matter?

Insurance claims processing automation is necessary for the success of insurance companies. You might be surprised, but there is a great correlation between the effectiveness of your claims settlement process and the loyalty of your end-users. The survey on global claims customer satisfaction defines speed (95%) and transparency (94%) as two core factors that impact customer loyalty in claims management. Of course, this is aside from the perceived fairness of the settlement process.

The insurer also wins on claim automation, being able to reduce labor costs. Manual insurance claim processing takes much time because of the volume and complexity of unstructured data. According to IBM research, insurance agents spend as much as 30% of their time searching for the information that is needed to handle the claim, for example, medical certificates or reports, photos of damaged property, policy reports, and so on. Different formats are used for claims data, such as media or text. The data is also shared via different channels, like emails, phone calls, messengers, or person-to-person conversations. All this significantly complicates handling claims manually.

Manual claim processing is also costly and less accurate as compared to claim prediction and processing using machine learning. Without technology, the risk of human errors, such as mismatched financial data or wrong consumer details, increases. This lowers the loyalty of customers and affects the insurer both financially and in terms of reputational damage.

How machine learning can optimize claims management?

By implementing machine learning in claims processing, insurers can get a unique advantage of how they handle claims — faster, more efficiently, and more accurately.

Speed and efficiency

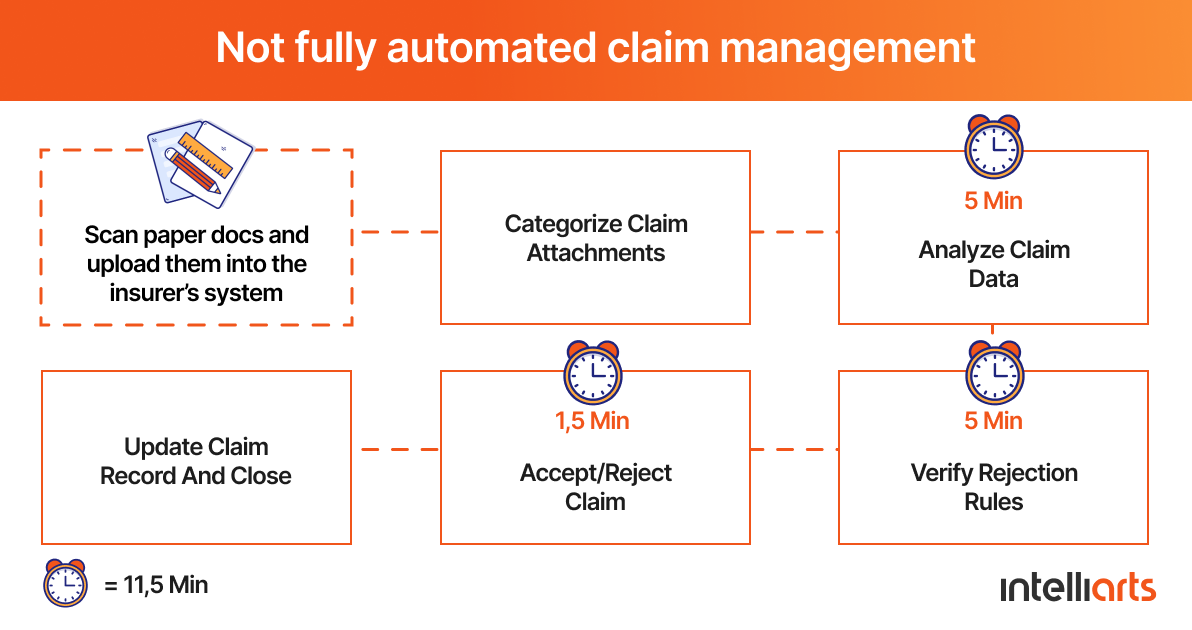

The case study by Insurance Thought Leadership reveals that the insurer’s health claims handling process usually takes around 11.5 minutes, from submitting the receipt to updating or closing the record.

However, this claims processing time shortens to three minutes only if an ML model is used to automate the process. This means a 74% reduction in time needed for automated insurance claims management, which can cause up to an 80% increase in productivity, as per the study results.

Accuracy

The same case study conducted by Insurance Thought Leadership confirms that AI claims processing can manage health claims with 80% accuracy. The only thing that affects accuracy refers to database limitations and spelling errors. However, since your ML solution tends to “learn” over time, insurers should expect fewer errors as time progresses.

ML algorithms can also be useful to spot “red flags” in fraudulent claims as well as ML in insurance risk assessment can significantly enhance the precision of predicting and managing potential risks. An ML solution could help to solve the most frequent, high-volume insurance claims, such as broken windshields, faster and more accurately. Hence, insurance agents would have extra time to spend on complex claims and fraud detection.

ML can be useful in intelligent underwriting too, don’t miss a related reading on this topic.

Traditional vs. ML-based claims management

Now let’s use a specific example of claims processing during a motor accident to see the difference between traditional vs. ML-based claims management.

Traditional claims processing

If our hypothetical auto claim discussed in the intro part is to be processed in a traditional, manual way, it would be painful and time-consuming. First, a customer submits a claim with all the information about the case, such as damages, receipts, and others. This data gets transferred to the insurance agent who has to assess the validity of the claim, look at all the proofs, and inspect the damage. It’s likely the insurance carrier would need to inspect the damage by themselves to document it and estimate its costs more accurately. Hence, the insurer’s representative would have to the scene of the accident, the customer’s home, or work, and more time will be needed for claims processing.

Only when the claim is approved, the claimant will get their money. But until this happens, the insurer can put the customer into a lot of trouble. The customer won’t have any means of transportation or, even worse, they will have to wait too long for the costs to compensate for their medical expenses.

But what if the insurer implements machine learning for automated claims processing? Will it make any difference to the company?

ML-based claims processing

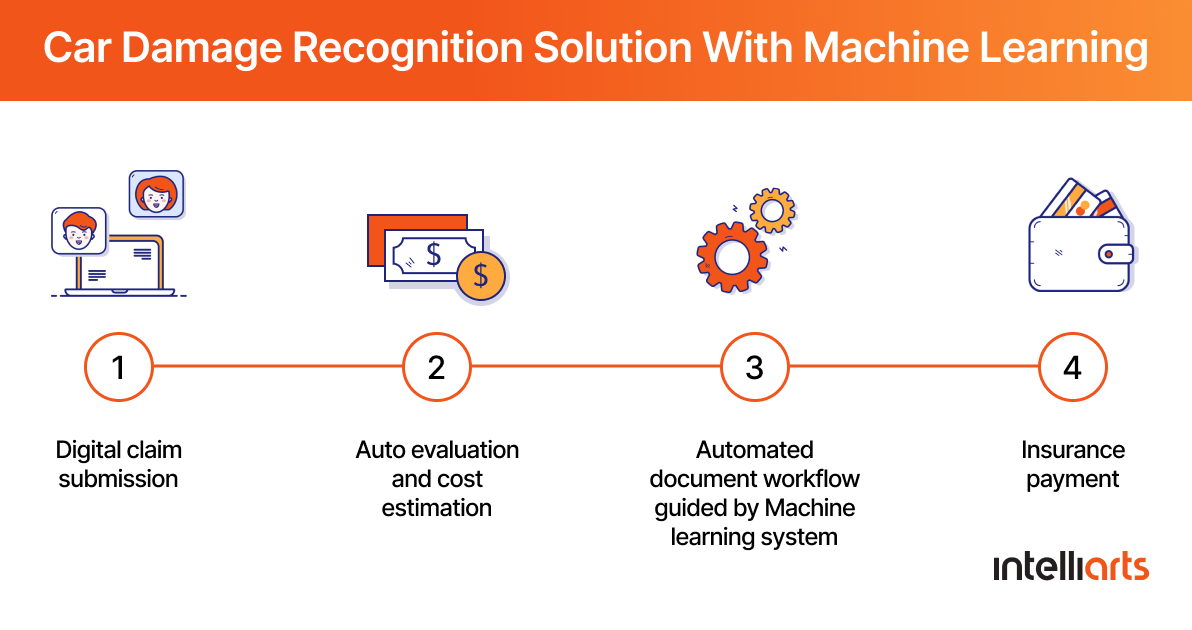

A totally different story will wait for the insurer if the company implements an ML solution to handle its insurance claim processing. In this scenario, the claimant could submit the claim through pictures. In other words, the customer takes a few photos of their motor vehicle that was damaged and then sends these pictures to the insurer.

Your system backed up by ML and especially deep learning algorithms would assess the damage automatically and in the shortest possible time. An ML-powered solution could even suggest some monetary value to those damages, which will be truly helpful for the agent assigned to manage the claim. All the documentation processes could be automated as well, with workflows to be quicker and more efficient with the help of ML. Eventually, the claim will be handled much faster, which will improve the loyalty of your customers.

In case you wonder how to bring an AI claims processing in insurance idea to life, our highly expertised team of engineers will be glad to help you.

ML-based use cases in insurance claim processing

So how exactly can ML be used in insurance claim processing automation? Below there are the four most popular applications of ML in claims management.

Smart claims triage

Claim triaging is the process in claims management that expects sorting out claims by urgency. This is especially critical when a disaster happens or simply during a peak season when the insurer has to deal with a large volume of claims.

If machine learning is engaged in claims triage, the insurer will be able to differentiate between light claims that could be settled quickly and more complex claims that would need the agent’s extra review. An ML solution will be able to assign a complexity/urgency score for each claim learning from similar historical claims in its database. Moreover, ML models are powerful enough to analyze a range of variables with high precision at once. Some parameters that could be considered during smart claims triage could include but are not limited to:

-

Injury severity

-

Litigation suspicious

-

Damage extent

-

And more

After an ML system defines what claim qualifies for a more thorough assessment, it could also assign it automatically to agents based on their workload and experience. Those claims that could be automatically accepted would be transferred straight to payments.

Damage evaluation

Partly mentioned, machine learning and computer vision technology, in particular, can be of great advantage in damage evaluation. Although unavoidable, the visual inspection usually takes much time in the auto insurance and handling property claims. The inspector should either visit the accident site or receive the expert’s report from a vehicle repair shop, which then has to be verified for no errors or unfair payments.

With an ML model in place, photos of the damaged objects just need to be uploaded, and the system will determine the severity and the costs of damage by comparing it to other damage pictures in its database. The Capco report covering the use of computer vision in the insurance industry tells about the ML-based system that can evaluate the damage of as much as 70% of auto collision claims. Supervised learning techniques were used to build this system, and it was originally trained with millions of pictures of damaged vehicles and their parts, the repair estimates of those damages, and some data of what was done to solve those damages. The solution has nearly 90% accuracy and, what’s more, continues learning.

Another great example of insurance claims processing automation is the use of visual inspection in assessing damage in property claims. The company below offers aerial intelligence for roof inspection instead of involving multiple parties (insurance agents and roofing contractors). Next, the insurance agent will have to upload those pictures from drones to an ML-based system and get the claim processed in a few days rather than spending weeks or even months for damage estimation.

Read also: AI Search for eEommerce

Auto-adjudication

This process refers to accepting or rejecting an insurance claim by checking its validity. For example, agents could check claims based on any errors or omissions, their appropriateness, and so on. Typically, this is a repeatable and tiresome process, which can be automated with the help of technology:

-

Rule-based claim auto-adjudication refers to using systems with pre-defined outcomes that work based on business rule engines programmed by human experts.

-

ML-powered auto-adjudication can be useful in more complex cases, such as reviewing less typical documents and images. For example, an ML-based system can use computer vision and natural language processing to extract information from texts and images automatically.

Fraud detection

ML algorithms also work well for fraud detection and fraud prevention in insurance claims. In the US alone, losses from insurance fraud reach from $38 to $83 billion yearly, as stated by the Insurance Information Institute. This problem becomes more urgent since fraudsters come up with new schemes faster than insurers get to know about the older ones.

By using ML, an insurance company could automate reviewing claims for fraud detection. For one thing, the system can handle a large volume of claims and do it more efficiently than an insurance agent. For another, insurers should not forget that ML models can “learn”. ML-powered claims processing systems will learn about new scams and the changing characteristics of fraudulent claims on the condition that the insurer feeds the model with new data.

In case you want to know more about ML fraud detection use cases and get a detailed description of how to build an ML system, this article on insurance fraud detection is a must-read for you.

How to reinforce automated claims processing

In the insurance industry, it all comes down to claims handling. The way how effectively an insurance company deals with insurance claims influences the company’s profitability, customer loyalty, and bottom line.

Automated claims management via machine learning seems a prospering solution here. While reducing the tedious paperwork, the insurer can also improve the speed, accuracy, and efficiency of claims processing as well as detect customer churn. Implementing ML into the claims management process is challenging, though. The insurance company would need to:

-

Understand whether its data is sufficient and quality enough to use for ML-based claims processing

-

Organize and clean the data so it’s suitable for modeling

-

Research and experiment with different ML algorithms to get to know which are the best to use in this specific claims processing case

-

Evaluate the results and understand which models have brought the most value to the project from the business perspective

-

Deploy the model(s) and continuously check and improve the results

For sure, all this is impossible to bring to life unless you have a professional ML team by your side. If you decide to use external services, you might find useful this article about composing an efficient software development rfp.

Intelliarts works by the CRISP-DM methodology, the stages of which are listed above, and our data scientists have both industry and business knowledge. We help insurance companies improve the claims settlement process with the use of machine learning.

Thinking about implementing ML to optimize your claims processing? We at Intelliarts are ready to give your company a hand and build a fully-fledged ML solution for you.

FAQ

In insurance claims, AI use cases include automated document analysis, fraud detection, and customer interaction via chatbots. These could help businesses streamline processes, improve accuracy in damage assessment, and enable predictive analytics for risk assessment for better efficiency.

Machine learning (ML) in insurance underwriting means using algorithms for analyzing amounts of data and identifying patterns that help to assist risks associated with policyholders.

Supervised learning algorithms like decision trees, random forest, or neural networks are most widely used in insurance. Their application is common for fraud detection, risk assessment, and claims processing. Unsupervised learning algorithms like clustering may be used for pattern recognition and anomaly detection in large datasets.