Updated in May 2025

Digital transformation is inevitably approaching businesses within the insurance industry, raising new challenges and bringing opportunities simultaneously. The use of modern technologies can improve the way insurers interact with their customers, streamline operations, enhance risk assessment and management, and a lot more.

The global AI market is projected to reach $184 billion by the end of 2024, showing a Compound Annual Growth Rate (CAGR) of 28.46%. The tendency seems to be solid. And, since the growth tempo is high, the market is still far from being saturated.

As of now, the usage of computer vision for insurance purposes is rapidly increasing. Let’s find out how car insurance companies use AI, how this transforms the sector and what benefits and opportunities it brings. You’ll also review use cases of computer vision in insurance and explore a practical case study by Intelliarts on developing a two-model computer vision solution for car damage detection.

How does computer vision technology impact insurance?

The insurance industry is undergoing significant transformation due to advancements in technology. Traditional methods of underwriting, claims processing, and customer service are being replaced by more efficient, data-driven approaches. Insurers are increasingly adopting technologies such as artificial intelligence (AI), machine learning (ML), and computer vision to streamline operations, reduce costs, and enhance customer experiences.

From what I can observe, the insurance industry tends to adopt automation when possible. ML provides such an opportunity due to, among other ways, computer vision technology. There’s no reason to hesitate with the implementation of computer vision technology as of 2025 and beyond.

Looking for a trusted provider to help you with computer vision or another ML project? Reach out to Intelliarts.

Benefits and opportunities for insurers to use computer vision

Without further ado, here are the specific opportunities that reveal the high importance of computer vision in insurance:

Process enhancement and automation

Computer vision technology allows insurers to streamline and enhance traditional processes such as claims processing, underwriting, and risk appraisal. By automating these tasks, insurers can achieve higher accuracy, faster processing times, and improved customer satisfaction.

For instance, automated vehicle damage analysis through computer vision in insurance can significantly reduce the time required for claims assessment and settlement.

Read also: Machine Learning for Risk Analysis

Rapid scaling of AI capabilities in the process

An interesting fact is that AI evolves as it’s utilized more. Models are trained on larger datasets, enhanced with other technology, such as Retrieval Augmented Generation (RAG) or data pipelines, and wrapped as more convenient chatbot or mobile app-based solutions. Altogether, it results in noticeable progress that can be achieved over the years. So, utilizing AI in insurance now promises even better capabilities and benefits to be acquired over time.

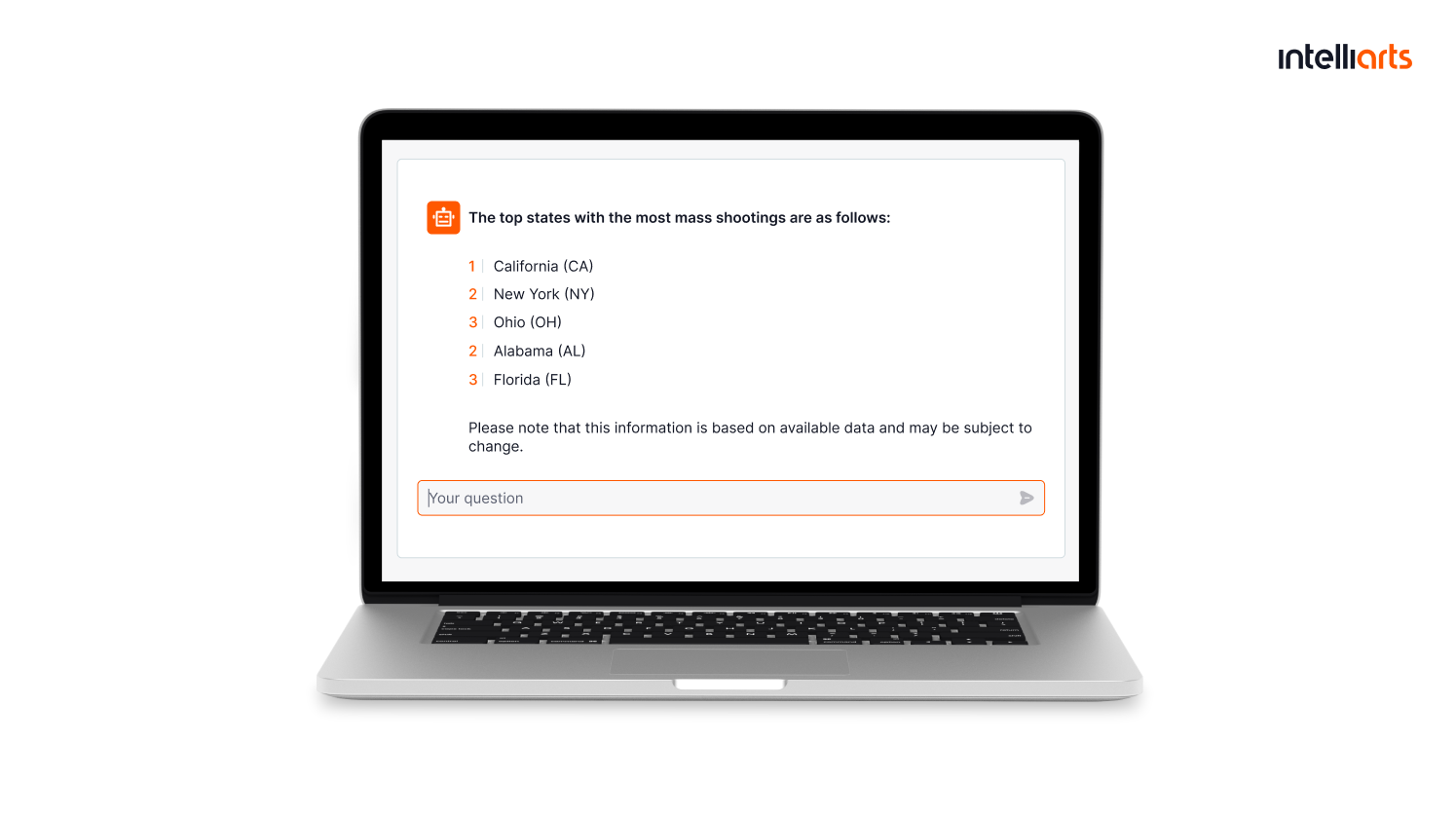

In one of our past cases, the Intelliarts team created a data extraction chatbot that’s reinforced with RAG capabilities. Such a solution is an example of how AI can reinforce traditional workflows.

Besides, you can acquire more information about RAG models from another blog post by Intelliarts.

Computer vision solutions to specific needs

The best thing about insurance applications with computer vision is that they can be perfectly tailored to a particular company.

For example, computer vision insurance solutions for detecting car damages are truly multi-purpose and suitable to most insurance businesses, as vehicle damage claim processing is an extremely common procedure. Such computer vision technology in insurance can be trained on a particular database with cars and their repair costs indicated. This way, it can work perfectly for particular insurance businesses because it is tuned to operate with images of specific cars and provide more accurate, realistic estimates.

As evidence, McKinsey states that about half of insurance activities can be automated due to the combination of machine and deep learning models built within the technology stack.

Cost-efficiency

The development of AI-based solutions in insurance promises to be investment-effective. Although the entry barrier can be high because of the development and implementation costs, it can be upgraded over time at lower expense. At the same time, the proper adoption of a computer vision solution can drastically reduce manual labor involvement, thus cutting costs.

McKinsey claims that computer vision can reduce claim processing costs by 30%, which can be an incredible business advantage over competitors.

Should you need tech consulting services, don’t hesitate to contact the Intelliarts team of expert developers.

How car insurance companies use AI: 6 use cases

The best machine learning applications in insurance are many. For now, let’s focus on the most common computer vision insurance tasks of AI-driven systems within the niche:

#1 Fraud detection

Fraud in insurance claims technology happens quite often, leading to insurance businesses losing an estimated $5.6 to $7.7 billion annually to automotive insurance fraud alone.

Naturally, companies aim to minimize efforts on case investigation and lower the rate of incorrect payouts, as it has a direct impact on the brand image and business profitability. In this computer vision use case, the technology assists in identifying invalid documents or detecting fake images. Some other forms of analyzing unstructured data may also be applied.

You can discover more about fraud detection in insurance from another of our blog posts.

#2 Roof condition assessment

Checking the roof’s age, condition, and characteristics, as well as estimating its potential vulnerability to external forces, is both time-consuming and physically challenging for inspectors. Insurance companies often have to rely on information provided by homeowners, which results in additional business risks. With computer vision for property risk assessment and high-resolution aerial imagery, inspectors can get roof condition estimates of thousands of buildings with significantly fewer efforts.

You can explore a use case scenario of real-life usage of computer vision for roof condition appraisal in the video below:

#3 Wildfire risk assessment

In wildland-urban regions, wildfires are a frequent cause of property destruction and insurance losses. Calculation of the hazard score most often relies upon aerial imagery processing. Computer vision helps to measure elevation, acreage, and defensible space between structures and vegetation and even detect the presence of potentially combustible materials. This way, insurance companies may get a precise assessment of risks related to providing insurance services to owners of a particular property.

#4 Surveillance on construction sites

The construction process is associated with large labor safety and on-site construction material damage risks. A computer vision and automated safety analysis with the help of a surveillance system is often implemented to minimize unfortunate occurrences. Here’s what it helps to monitor:

- Usage of necessary equipment

- Proper execution of processes

- Signs of potential failures

#5 Vehicle damage assessment

There is a huge technology impact on accident insurance claims processing. In the event of an auto accident, computer vision can quickly analyze images of vehicle damage. This technology streamlines the claims process, reducing the need for manual inspections and speeding up settlements. Insurers can provide faster and more accurate assessments, improving customer satisfaction and operational efficiency. Here are the possible outcomes of applying computer vision for car damage detection:

- Easy confirmation of the correspondence between the actual car and the one indicated in the documents

- Detection of the area of damages

- Identification of damaged parts

- Repair cost estimation

You can also read about AI-based object counters solution by Intelliarts.

#6 Customer engagement and support

Computer vision in insurance enhances customer engagement by enabling policyholders to submit images for instant quotes or claims processing through mobile apps. Using customer support and text generation in insurance improves user experience by providing quicker service responses and reducing the workload on customer support teams. Automated image analysis ensures accurate and efficient handling of customer interactions.

Looking for insurance software development services? Visit the corresponding service page on the Intelliarts website.

Intelliarts’ experience: Two-model computer vision solution for car damage detection

As a part of our R&D activities, the Intelliarts experts built a top-rated two-model computer vision-based solution. This PoC was intended to be a basis for any large-scale solution capable of assisting insurers automate car damage assessment.

Here’s how our two-model computer vision solution works:

- Model for car part detection. Identifies distinct car parts in the image. Determines their visual borders and labels them with corresponding car part names.

- Model for car damage detection. Identifies the presence of damage. Determines the visual boards of the damaged area and provides a rough repair cost estimation.

This way, the outcomes of image processing are identified as damages and specific car parts. If they intersect, the solution output results, for example, as “left door — dent.” The outcomes are then compared against similar cases in a prepared image database with repair cost estimations.

The solution works best when trained on the appropriate database of cars, with parts correctly labeled in the reference dataset of images. Accurate repair cost references are also needed for the model to estimate them correctly while working with images from real-life cases.

You can test the demo version of the computer vision model for car damage detection by Intelliarts in the Hugging Face environment.

Final thoughts

Computer vision technology finds its usage in insurance in a variety of ways, from vehicle inspection and wildfire risk assessment to fraud detection. If adopted wisely, such AI solutions can bring notable enhancements to traditional workflows, offering manual labor involvement and cost reduction.

Implementation of computer vision in insurance requires high expertise. If you aim at getting the most out of such an investment, then let a team of AI and ML professionals from Interlliarts contribute. With more than 25 years of experience in the niche, we can address any of your dev needs with flying colors.

FAQ

1. How does computer vision technology affect insurance premiums for policyholders?

Computer vision can lower premiums by improving accuracy in risk assessments, detecting fraud, and automating claims, benefiting policyholders.

2. What challenges and limitations exist in the adoption of computer vision for insurance claims processing?

These include accuracy and data quality concerns, bias potential, integration issues, and resistance from traditional claim adjusters.

3. Is computer vision technology secure, and how is customer data protected during the claims process?

While inherently secure, data protection relies on robust encryption, strict access controls, and compliance with data privacy regulations.