Updated in May 2025

Machine learning for underwriting alters how businesses evaluate risk, assess applicants, and automate decision-making across various industries, from insurance to real estate to fintech. Although traditionally conservative and process-heavy, underwriting is now undergoing a rapid digital transformation powered by AI and ML technologies. These tools have revolutionized underwriters’ daily operations, improving accuracy, reducing the process time, and increasing overall machine learning underwriting efficiency.

From better underwriting risk calculation to automated claims processing, machine learning helps organizations make more data-driven decisions and streamline operations. In this article, we explore key ML applications in underwriting and their impact across industries. Without further ado, let’s see what the benefits of ML underwriting are, as well as its challenges.

Underwriting 2.0: Shift to intelligent underwriting

Traditional manual underwriting is associated with piles of physical and digital paperwork, back-and-forth communication between stakeholders, entering and rechecking lots of information submitted into the system. This is without mentioning a cumbersome and time-consuming process of evaluating risk to determine whether to approve a deal — and under what terms.

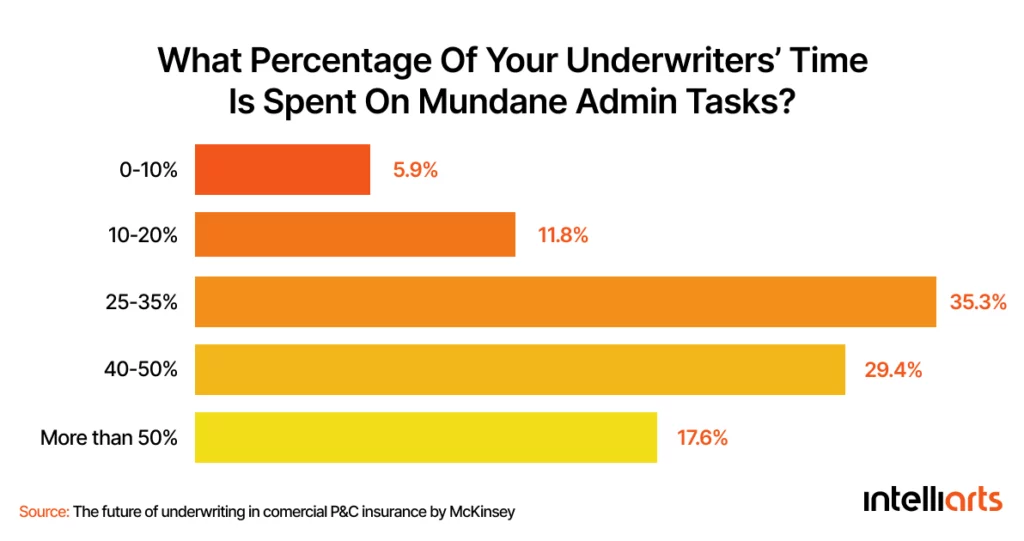

McKinsey hassurveyed businesses on how much time their underwriters spend on mundane admin tasks. 35.3% of the surveyed pointed to spending a third of their time on such tasks, while 29.4% specified that almost half of their working time goes to this activity.

Interestingly, such efforts don’t lead to anything more, but human errors, inefficient operations, and increased underwriting expenses, primarily due to the waste of expensive human hours. Instead of automating the underwriting system and making more efficient use of expert talent, businesses suffer the consequences of manual underwriting.

Still, the rise of ML and AI technology proves that, in a few years, underwriting as we know it today is doomed to failure. According to the GlobalData Engineering Technology Trends Survey, 62% of companies are already investing in disruptive technologies, and at least half of them state that AI and ML will be crucial for their businesses in the next few years.

It’s not really surprising if we consider how algorithmic underwriting helps better analyze risks, provide more accurate pricing, and process applications faster and more efficiently. With ML and deep learning technologies, the underwriting process time is reduced to a few minutes (instead of hours or even days) because most activities are automated and data-driven. As Matthew Josefowicz, a technology strategist and opinion leader in insurance, summarizes it,

New technology is allowing underwriters to spend more of their time building and strengthening relationships in the field and, in many cases, acting as the frontline interface of the company with the marketplace.

Obviously, intelligent or predictive underwriting makes sense, but how exactly can machine learning for underwriting be useful?

ML-based use cases in underwriting

Automate submission triaging

An interesting use case of machine learning in underwriting includes AI automated underwriting clearance and triage, i.e., using ML algorithms to triage submissions, filter applications, and assign them to underwriters in the most effective way. Predictive underwriting in this case contributes to creating a more efficient working model as ML helps to prioritize submissions based on different factors and make sure that a particular application will be handled faster.

For example, an underwriting ML system can filter the applications based on their complexity and assign them for review to the underwriter with the appropriate level of knowledge. Another example includes prioritizing submissions by category, such as loans, leases, or policy types, and routing them to specialists with relevant domain knowledge for faster and more accurate evaluation.

These ML assistants become helpful for underwriters to focus their time on high-impact cases rather than manual sorting.

Streamline your submission processing

Handling new underwriting submissions means going through volumes of documents within the shortest deadlines possible. As said, doing it manually takes not only lots of time but is inefficient and error-prone.

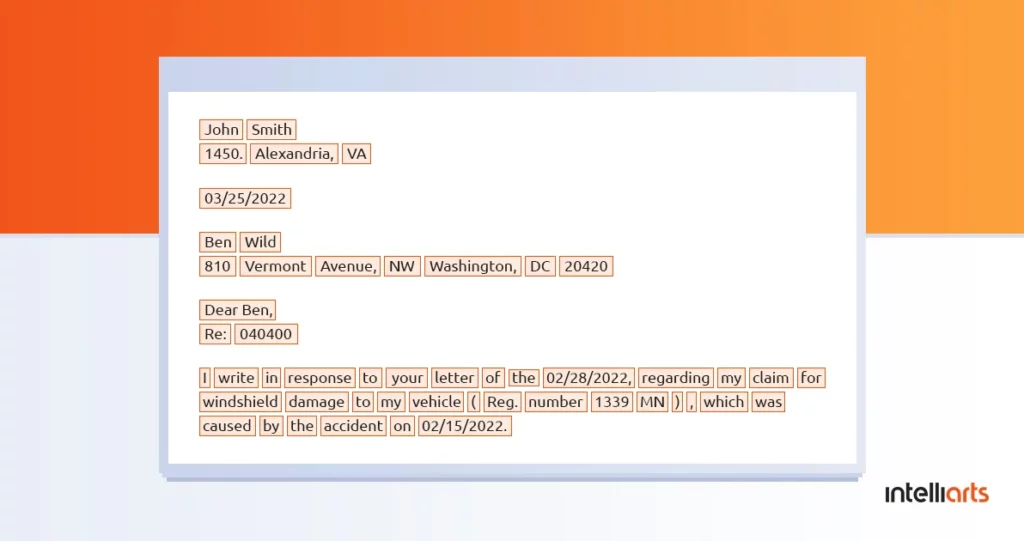

The application of ML and AI can yet bring lots of value in this case by enabling automatic data extraction from DPFs, printed and handwritten documents, and emails. As part of data science, technologies like optical character recognition (OCR) and natural language processing (NLP) are particularly effective for searching, retrieving, and processing relevant information when integrated into the underwriting machine learning system.

Read also about the AI-based object counter solution by Intelliarts.

Automated data extraction: Optical character recognition

As a result, using ML-powered solutions gives underwriters a chance to process new submissions more efficiently. Instead of wasting time looking for underwriting information, such as an applicant’s names, addresses, risk types, or partner details, and entering it into the system manually, professionals can rely on fully automated systems to extract and organize data quickly and accurately.

Assess risks more accurately

After the application is filed, the next step is to calculate its risks. The organization has to determine whether a particular applicant poses an acceptable risk and approve or reject the submission.

Artificial intelligence underwriting systems will be useful for analyzing submission and calculating related risks. Underwriters no longer need to rely on applicant-provided data only, which could have mistakes and omissions, intentional or unintentional. In contrast, ML systems can assist underwriting with getting information from alternative and more diverse sources and, thus, promote a 360-degree approach to underwriting risk analysis. Machine learning for underwriting can help check an application profile against loads of data points retrieved from social media platforms, banking records, publicly available statistical data, and third-party databases.

This way, the risk analysis will be more accurate, but organizations can also benefit from operational improvement. Using text classification, ML-powered smart underwriting systems can automatically process all the submitted and researched data and compare it to industry standards. Then, the system will present the results to underwriters for interpretation.

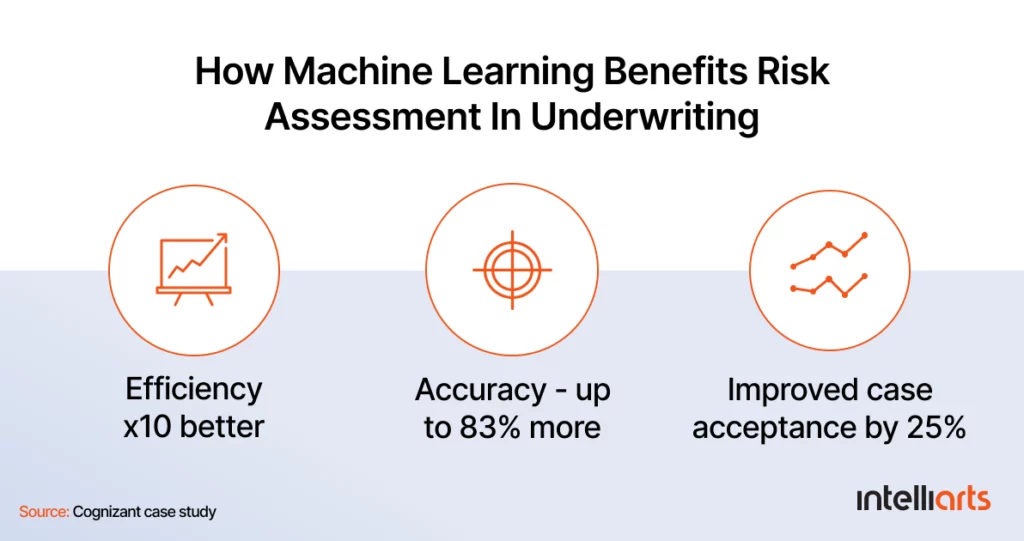

Let’s check the example of one insurance company that used an ML algorithm for predicting the likelihood of flooding in the area based on historical and geospatial data. The adoption of ML technology into the operations allowed the company to increase the accuracy of underwriting services to 83%, generate a 10-fold reduction in throughput time, and increase case acceptance by 25%.

Optimize rates for premiums

Any risk assessment in underwriting ends with determining the terms of the contract, such as the amount of coverage, financing, or liability an organization is willing to extend to the applicant, assuming the submission is approved at all.

However, here’s an interesting observation: the McKinsey study tells about a small business owner receiving quotes from five different providers for the same service, only to find a staggering 233% difference in pricing.

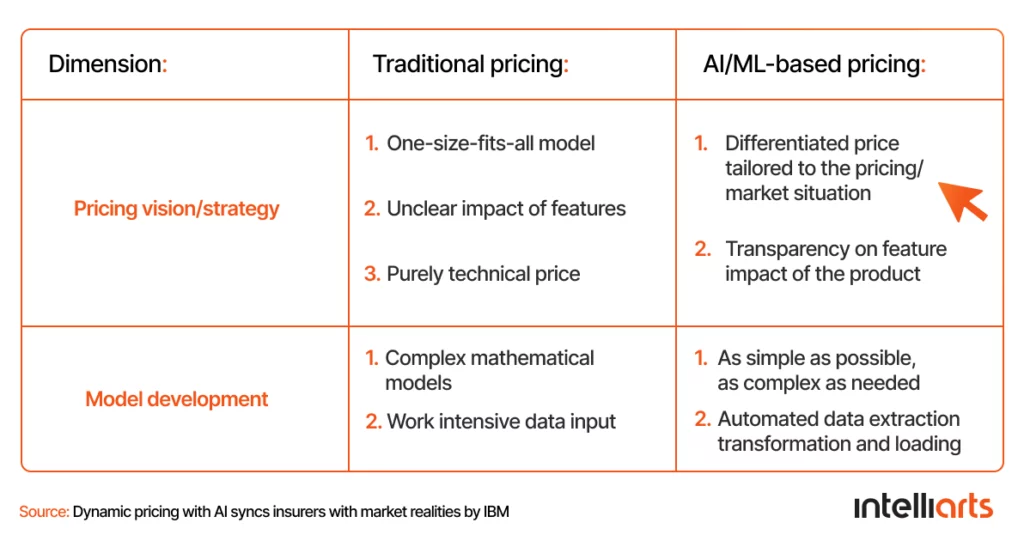

Getting pricing right in underwriting is challenging. Traditionally, industry leaders relied on the “cost-plus” method, which meant calculating the risk premium based on direct and indirect costs as well as a margin uplift.

Although the method is workable, it has its drawbacks, mainly excluding any non-technical pricing factors and being unable to quickly adapt to market fluctuations. And when pricing rates do not align with market conditions, whether being too high or too low, the outcomes are the same: high underwriting expenses, lost revenue, and narrowing margins.

Now think about incorporating AI and ML technology into your underwriting analysis. In this scenario, pinpointing optimal pricing rates means relying on a broader array of data:

- Geospatial Information Systems (GIS)

- Projected real estate market fluctuations

- Geopolitical risks

- Weather and climate forecasting

- Real-time data from IoT networks

- Social media

- And many other data sources that your company can have access to

Aside from getting more fairly-priced premiums, your business can offer more personalized quotes to end-users. For example, IBM informs that today’s most complex smart underwriting systems can recalculate premiums based on specific customer input and circumstances like kilometers driven or goods transported. Thus, AI and ML technology give way to a more client-centric approach to underwriting risk pricing calculations and optimization.

Improve coverage recommendations

In various industries, the submission review ends by presenting the applicant with the best coverage recommendation. AI and ML technology have a lot to offer in this case, too.

In our experience, the Intelliarts team has developed ML-based recommendation engines that could help with coverage judgments. By analyzing historical data and previous submissions, such systems can predict the most suitable loan amounts, interest rates, and repayment conditions for each applicant based on their financial history and risk profile.

Similarly, in real estate, ML-powered systems can help agents recommend the right mortgage options for buyers, considering factors like credit history, property location, and market trends. These systems analyze past property transactions and buyer behavior to suggest personalized offers that fit the buyer’s needs.

Across all these examples, machine learning for underwriting enables businesses to offer more personalized and relevant options to their customers. As a result, companies can expect an increased conversion rate in sales and probably more loyal clients. More importantly, the IBM report states about a 2 to 3% increase in premiums as a result of this personalization, which means increased revenue for businesses.

How else ML can be useful in underwriting

1. More accuracy

The distribution chain in underwriting can be lengthy, with one submission reviewed by several employees. The more people involved and the more manual work, the lower the accuracy becomes in the submission review. People get tired and bored, so they make mistakes — but ML algorithms don’t. That’s why implementing an ML-based underwriting system will improve the accuracy of your risk assessment. Besides, by using machine learning models for underwriting, you can handle incorrect and superfluous data much better, being trained on historical data sources.

2. Less pressure on employees

Traditionally, underwriting has relied on human expertise, and this is understandable and will remain as it is. Still, AI and machine learning in underwriting could “unload” underwriters, taking the most tiresome and repetitive work from them. Instead, employees could focus on more interesting and complex cases of risk assessment.

Sofya Pogreb, the CEO at Next Insurance, comments on the current situation in the following way,

We believe with technology and machine learning, a lot of [human underwriting] can be done away with. The percentage of insurance applications that require human touch will go down dramatically, maybe 80% to 90%, and even to low single digits.

3. Better customer service

Customer service is of the utmost importance in any industry. Using machine learning for underwriting will benefit from the services delivered faster and more efficiently to your customers. Implementing machine learning also brings more precision and personalization to underwriting.

Here are some other examples of how ML can improve customer service in underwriting:

- Offering personalized vehicle lease or financing terms based on driving data points and personal driving behaviors

- Dynamically updating the number and type of questions an underwriter should ask during the application process, depending on the applicant’s profile and prior responses — useful in industries like lending, equipment leasing, or commercial real estate

- Delivering more accurate property valuations by using object recognition to assess the physical condition of a building, the materials used, or signs of wear — relevant for underwriting in real estate, facility management, or asset-backed lending

Challenges of machine learning underwriting

Despite the advantages we mentioned, we cannot ignore the challenges that machine learning can bring to industries. If your company is going to implement predictive underwriting, think about:

- The lack of data: The effectiveness of ML algorithms depends on data availability. And this must be quality data, without duplicates, null, and missing values. Data fuels ML not only as the “training material” but a way to make the models smarter in the future.

- Data security: Whenever it comes to massive data amounts, businesses have to consider data security and safety. Make sure your company has safeguarded itself from data breaches and leakages.

- Proper infrastructure: Implementing machine learning also means having proper data infrastructure, as another important element for ML performance. Think in advance (or better discuss with ML experts) where to store and how to manage data in a productive way.

- Expertise: Implementing an ML model is easier under the guidance of ML professionals, especially if they have relevant domain knowledge. Intelliarts has a proven record of successful AI and ML projects across various domains, and we’ll be glad to help you.

Empowering underwriters with machine learning

With businesses across industries dealing with growing volumes of data and undergoing digital transformation, more organizations recognize the merits of implementing AI and ML solutions. Teams responsible for evaluation and decision-making like underwriters can especially win on machine learning for underwriting by:

- Prioritizing submissions and assigning them to the most appropriate specialists

- Processing documents during the application review faster and more efficiently

- Calculating risks more accurately

- Pinpointing more optimized rates for premiums

- And giving personalized offers to their clients

Getting started with ML can be challenging, though. In case your company is looking for a professional team for the full-scale development of an ML-based underwriting system, we are ready to assist. Working according to the CRISP-DM methodology, we take an all-around approach to insurance software development. Also, if you want to reduce and predict customer churn, we are here to help you.

Whether you’re in finance, real estate, energy, or logistics — if your business involves complex assessment workflows (be it applications, risks, or document review), smart underwriting can significantly improve speed, accuracy, and personalization. Now is the time to explore its potential. Let’s talk.

FAQ

Can machine learning underwriting be applied to different Industries?

Yes, machine learning underwriting can be applied across various industries, such as finance, healthcare, real estate, logistics, and energy, anywhere complex assessments of risk, documents, or applications are needed.

How will machine learning underwriting shape the future of the assessment processes across industries?

Machine learning underwriting can transform assessment processes by automating data analysis, reducing manual work, and enabling faster, more accurate, and personalized decisions. Across industries, this means improved efficiency, better risk evaluation, and more adaptive, scalable operations.

Can small companies benefit from machine learning underwriting as well?

Yes, they can. ML-based underwriting is available to small, medium, and large businesses.