The competition in today’s US insurance market is tough, with around 6000 businesses operating in this sector, according to the Insurance Information Institute. To beat this competition, insurers are exploring various options available to them, among which implementing machine learning (ML) technology across the insurance value chain.

In this article, read about five machine learning applications in insurance. Since the insurance industry has grown an immense appetite for data during the past two years, explore how ML can help your company unleash the potential of this data, process, and use it right.

Drivers of machine learning and data science in insurance

When it comes to machine learning, we’re basically talking about extracting knowledge from data. According to IBM, machine learning can be defined as,

A subfield of artificial intelligence (AI) and computer science that focuses on the use of data and algorithms to imitate how humans learn, gradually improving its accuracy.

Deriving from historical data, an ML algorithm can learn on its own and make predictions and conclusions without being explicitly programmed. So an ML model generates the results as accurately as possible, and it’s important it was fed with enough quality data. Partnering with an IT consulting firm can ensure the proper handling and preparation of this data.

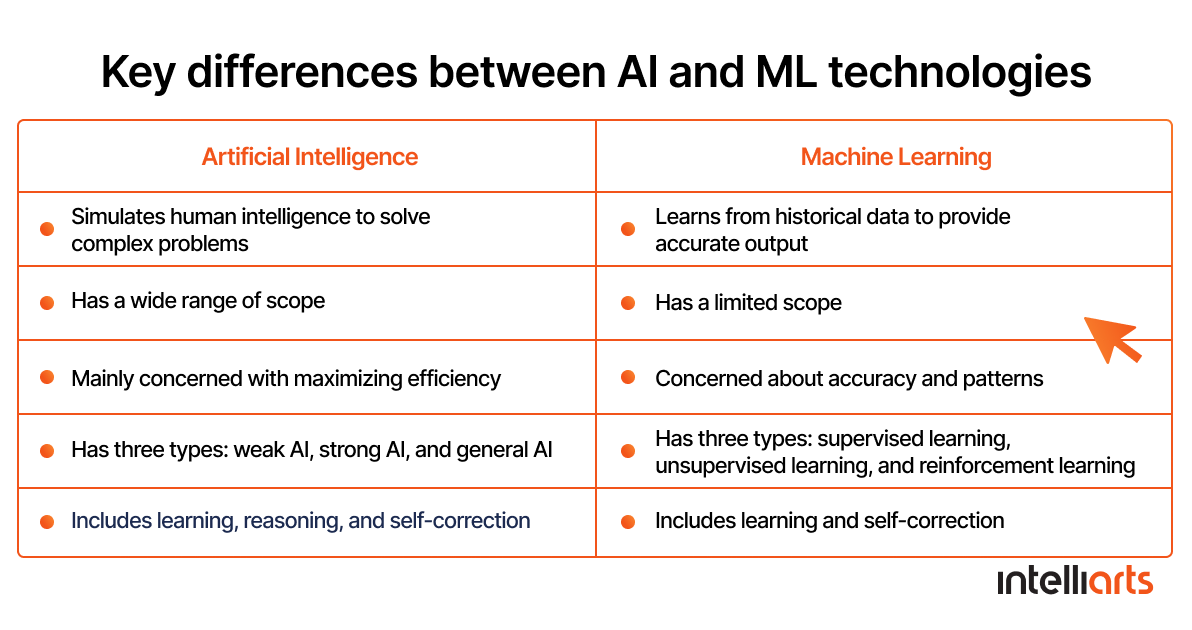

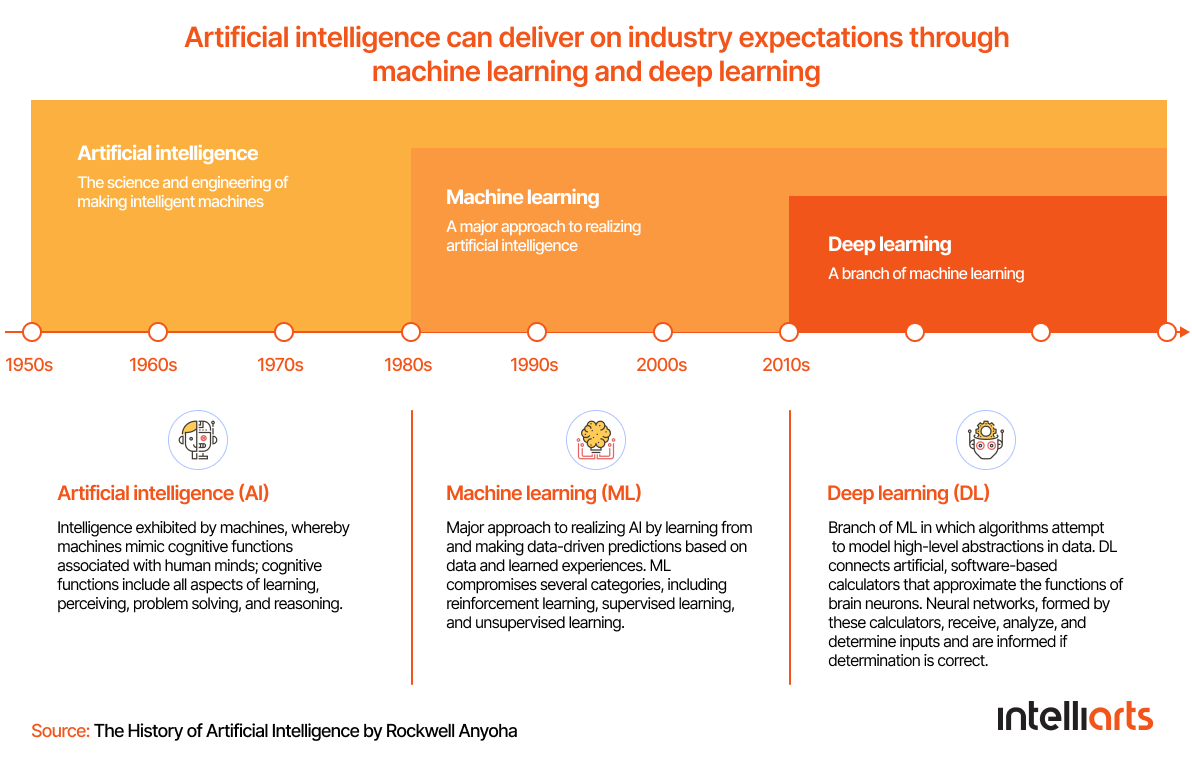

Not to get confused about different terms used, there is a substantial difference between AI and ML. As implied by its definition, machine learning is a branch of artificial intelligence. While both belong to computer science, AI is a broader concept than ML that is designed to simulate human thinking capability and behavior. From a business perspective, both AI and ML can help to conduct business operations better, with more accuracy and lower spending.

Another critical concept here is deep learning. Alike, it’s a subset of ML that handles algorithms inspired by the structure and function of the human brain. The major difference between machine learning and deep learning lies in how the data gets presented to the machine. While traditional ML algorithms rely on structured data, deep learning can deal with massive amounts of both structured and unstructured information working based on the multiple layers of artificial neural networks.

What’s important is that machine learning is more than a hype approach used to bring innovation to the insurer’s workplace. Modern insurers choose ML and apply data science in business for a bunch of reasons:

- Increase in data volumes — Today, connected consumer devices, such as smartphones, smart TVs, or fitness trackers, are becoming increasingly popular. This explains the growing number of data in the insurance industry. Insurers can use this data from IoT devices and evaluate customers’ profiles more accurately.

- Strong potential for automation — McKinsey predicts 25% of the insurance industry to be automated by 2025. The industry indeed has lots of areas to be automated, from claims management to policy cancellation, and AI/ML handles automation perfectly.

- Open-source everywhere — With tons of data accumulated in the industry, open-source protocols are becoming mainstream to make sure this data is shared and used. Also, private and public sectors join forces to create reliable ecosystems where data is shared safely and securely.

- Better response to COVID-19 — The pandemic has taken a great toll on insurance businesses. Still, those insurers that have incorporated intelligent technologies appeared better prepared for COVID-19. For example, they were able to process claims fast and accurately, although having a large part of their workforce working from home.

Challenges of machine learning in insurance

Speaking about the drivers of ML in insurance, we should mention its challenges too:

- Absent knowledge of what data to collect: ML solutions are data-driven, and the performance of the future ML model largely depends on the data used to feed the algorithms. However, if the insurer lacks ML expertise, they might not know what data to collect. Paired with a skilled ML team, you can get advice on the best data collection methods as well as create synthetic data if needed.

- Expertise and technical competency: Of course, implementing ML in insurance might be difficult if you never performed it before. But again, by choosing the vendor with a tank of ML knowledge, you’ll be able to make sense of your messy historical data, build proper data infrastructure, select the right ML algorithms, and train the model efficiently.

- Digital mindset and culture: Adopting ML isn’t enough if your personnel refuse to use it in their daily activities. So, make sure you build a data-driven corporate culture, with clear cooperation between IT and other departments. A good starting point is to organize training sessions to teach the personnel how to use ML to the fullest value.

Now we’re ready to move on to specific applications of machine learning and deep learning in insurance.

Machine learning use cases in the insurance industry

Insurance is known for its high regulation and reluctance towards change and new technologies. Customers all over the world complain about lots of paperwork and bureaucracy when it comes to filing a claim or signing a new policy.

That being said, the insurance industry has become highly digitalized in recent years. And AI/ML technology played a prominent part in this digital transformation. The graph below illustrates the growth of AI/ML in insurance in different geographical regions from 2017 to 2024.

As we observe a global push towards digital insurance via the use of ML techniques, it’s high time to dive deep how machine learning can help an insurance company. Besides, let’s consider real-life examples of companies using machine learning in the insurance sector.

1. Intelligent underwriting

Underwriting is an important part of insurers’ daily work when a company calculates the risks of insuring someone’s business, assets, or life and picks up the right price for this deal. To explain the importance of ML in the insurance industry, the use of ML-enabled risk management systems allows insurers to speed up and facilitate underwriters’ work. A simplistic example of ML in underwriting includes making decisions on how deeply to investigate the case, e.g. full vs. simplified underwriting or whom to assign the case, e.g. junior vs. senior specialist.

Of course, AI and ML cannot entirely replace manual risk assessment in the insurance sector. Still, using machine learning in underwriting can increase operational efficiency and intelligent decision-making in underwriting in a range of ways:

- Automating submission triaging

- Streamlining submission processing

- Assessing risks more accurately

- Predicting potential failure rates and other operational risks

- Optimizing rates for premiums

- Improving coverage recommendations

Example in real life

A good example here is the success story of one global reinsurer, i.e. a company that provides financial support to insurance companies. Using historical and geospatial info, this organization built an ML algorithm to analyze the risk of floods in the area.

The implementation of the ML-based system allowed the reinsurer to:

- Reduce time spent on underwriting by ten times

- Model what to expect from the market in the future with 80% accuracy

- Increase case acceptance by 25%

2. Fraud detection

As probably the most challenging task in insurance, fraud detection makes insurance companies lose $80 billion annually, according to the Coalition Against Insurance Fraud. And while businesses are thinking about how to deal with fraud, malefactors are using this time to make up new fraudulent schemes and patterns. Also, this situation makes insurers add costs to premiums and increase prices from 10 to 20% on average, which puts an extra toll on customers.

Since ML algorithms work great for anomaly detection and classification of large datasets, companies rely on machine learning algorithms used in the insurance industry for insurance fraud detection. An ML system detects patterns and analyzes consumers’ behaviors, for example, transaction methods. If it notices any abnormal activity, it warns the insurer immediately.

With ML, insurers can detect fake and duplicate claims, and we’re not speaking about “exact matches” only but more complex cases. Add here also the frequent fraudulent cases of upcoding in medical bills and overstated repair costs in auto insurance.

So, here’s why you’d better choose ML for fraud detection:

- It identifies potential frauds faster and more accurately

- Next to structured data, ML algorithms can analyze non- and semi-structured data, including claims notes. This contrasts ML to traditional predictive models, which limit insurers to using structured data only

- ML allows insurance companies to add alternative data sources such as public data or third-party IoT, which improves fraud detection results

Example in real life

Before implementing an ML-based predictive fraud detection system, Anadolu Sigorta, the Turkish insurance company, wasted two weeks manually checking claims for fraudulent activity. As the company processed 25,000 to 30,000 claims a month, the costs were high.

After switching to a predictive system, Anadolu Sigorta became able to detect claims in real time. So, no wonder that it improved its ROI by 210% in one year only. Its total cost savings, thanks to fraud detection and prevention, included $5.7 million.

3. Claims processing

From claims registration to investigation, adjustment, and settlement, handling insurance claims also takes lots of time for insurance agents. Machine learning in insurance claims is another great application of AI or ML in the insurance industry and can speed up and automate these processes and, hence, reduce the time spent on claims processing and improve customer experience.

How can ML optimize claims processing?

- By claims registration: The typical claims registration process is time- and data-intensive. ML can provide insurers with analytical insights on how to remove these operation inefficiencies.

- By smart claims triaging: ML is also useful in scoring and triaging risks. If an ML system learns based on past experience, it will be able to prioritize insurance claims faster and more accurately.

- By claims volume forecasting: A typical stumbling block in an insurance practice is to set premiums before signing any insurance contract. An insurance agent, in this case, has to go through lots of manual work and make predictions about the number of claims occurrences and approximate claims amounts. With an ML system in place, the forecast for individual claims will be less error-prone and take less time. As a result, this can decrease the overall claims settlement time and improve customer experience.

- By smart auditing: Using ML algorithms in claims audit improves the quality of audits. Technology helps to identify only those claims that are indeed incorrect and need review. A technical audit can complement these efforts by evaluating the efficiency and security of the technology systems in place.

- Other use cases, including automatic and distant damage evaluation, ML-powered auto-adjudication, and automatic detection of fraudulent claims.

Example in real life

The Fukoku Mutual Life handles claims data with the help of AI and deep learning. Technology helps the insurer automatically find and access medical documents related to the case as well as calculate the pay-offs. As a result, the Japanese insurer can now boast of a 30% increase in productivity and cost savings of around $1 million a year.

4. Lead management

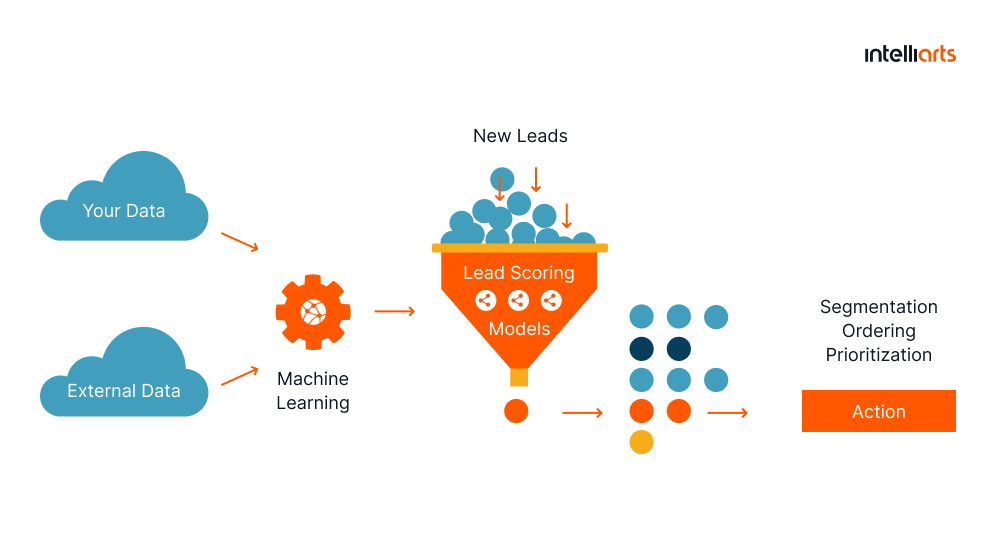

Insurance companies can also consider implementing ML-based insurance lead management systems to bring lead management to a fully new level. By extracting valuable insights from lead data, ML helps insurers with lead analysis and classification. So, companies can choose quality leads and don’t waste time on those with low conversion rates.

A powerful insurance lead management system can also help to calculate the sales threshold by analyzing various important factors, such as lead revert time, link clicks, or web visits. When a lead approaches the industry benchmark, agents will know it’s worth a cold call or a message.

Example in real life

The Intelliarts team built a predictive scoring model that could forecast the probability of how likely the lead would buy a policy. With this system in place, insurance agents could call leads with high scores first and leave those leads with low scores for later or skip them entirely in case of a lack of resources.

The business value was far above the expected. After only a few months in production, the model helped to cut off approximately 6% of non-qualified leads, which resulted in a 1.5% profit increase. In the most successful months, the customer noticed a 2.5% increase in profit.

5. Customer Service

Customer service makes up one more interesting application of machine learning. First and foremost, insurance companies can use machine learning to predict the churn rate. Detecting early churn signals and recognizing at-risk customers provide insurers with an exclusive opportunity to prevent customers from leaving the company before it actually happens.

Personalized marketing is another great use case of machine learning in insurance. Customers in insurance (as anywhere else) would like the services to match their specific needs and requirements. ML can help insurers deliver personalized and relevant experiences. By extracting valuable insights from demographic data, customer behaviors, attitudes, interactions, and lifestyle details, ML algorithms provide insurers with insights to exploit in their marketing initiatives:

- Personalized offers and policies

- Loyalty programs

- Insurance packages

- Pricing

- Messages

Last but not least, ML algorithms can come in handy in customer segmentation. Analyzing important data, such as customer income, age, gender, and location, ML classifies customers into different groups. It can also seek patterns based on more complex variables, such as behaviors or personal preferences. Using these conclusions, an insurer then develops specific attitudes or uses marketing strategies to target different customer segments.

Example in real life

In 2015, a life insurance company, MetLife, decided to take a data-driven approach to customer segmentation. At the time when insurers used ML solely for risk mitigation and underwriting, MetLife centered on ML to foster their go-to-market strategy and achieved great results.

ML algorithms helped the insurance company to understand the customers’ needs, behaviors, and attitudes better and, hence, maximize their competitive advantage. Later, MetLife summarized this experience as “the most significant change to their brand in over 30 years.”

6. Price optimization

ML algorithms can also be a tremendous help to insurers in building an effective pricing model. A traditional price optimization approach means accommodating GLM (Generalized Linear Model) to historical claims and premiums. GLMs are traditionally used as the main pricing technique, but this conventional approach:

- Doesn’t take into consideration the changeability of insurance pricing. Pricing uncertainty in this sector is high because of constant changes in claims procedures and regulatory requirements

- Doesn’t work in certain circumstances. Taking the same GLMs approach, the result — quoted premiums — can differ from one insurer to another. The study conducted by the Institute and Faculty of Actuaries proves that even for an ordinary risk, this difference can reach up to $1000

So how can you implement ML in insurance for premiums? Using ML for price optimization brings more accuracy and flexibility to pricing. For one thing, insurers can adjust prices dynamically, for example, by reacting timely to market fluctuations. For another, companies no longer need to orient on industry benchmarks but can make use of predictive models to set an effective price for each premium.

The major benefit of ML-based pricing models is an opportunity to include a variety of variables in the premium, with different levels of impact. ML algorithms discern patterns from data, integrate additional sources and channels (even alternative ones, such as previous claims or social media), and notice trends and new demands at early stages.

Example in real life

AXA is a global insurer giant that has tried using deep learning techniques to optimize its pricing. The company knew that 7 to 10% of its customers cause a car accident annually. While most of these accidents weren’t serious and cost little to the insurer, 1% of these made up large-loss cases with huge payouts.

As you might expect, AXA wanted to predict those large-loss cases to improve their pricing and cut costs. For this purpose, the company produced an experimental neural network model and entered 70 different risk factors into the model. Eventually, AXA achieved 78% accuracy in their predictions and improved their pricing a lot.

7. Data extraction

Going through tons of text documents like health records, financial reports, claims history, and even mental health EHR data takes at least half of a working day for those in insurance. No need to say that these tasks are monotonous and tiresome but require lots of accuracy.

Automatic data extraction such as through EMR software can be a lifesaver in this case:

- By scanning through texts automatically, ML algorithms retrieve core words and/or phrases from unstructured insurance documents. Even better, they can identify synonyms or related words, e.g. searching for a “pet” when you’re looking for a dog.

- Optical character recognition (OCR) enables image to text conversion along with the recognition of handwritten and printed texts, which helps insurers process documents faster and solve operational inefficiencies.

- One more use case includes generating automatic summaries of documents by using NLP algorithms. This way, insurance agents won’t need to read 100-page financial reports.

- Finally, AI for data extraction allows forgetting manual re-typing. When paired with computer vision in insurance, it can accurately render every single pixel and translate the information if needed. This is especially useful when it comes to customer onboarding and claims management, helping to extract customer information in the blink of an eye.

Example in real life

Tokio Marine uses an ML-based OCR service to handle claims. The system allowed the company to reduce human error by 80% and processing time by 50%.

Applications of AI and machine learning in the insurance business

You might be surprised but there are a few other ways of how machine learning and AI can be useful to insurance companies. Let’s take a look at them:

Customer Lifetime Value (CLV) Prediction

By analyzing customer demographics, claims history, buying behaviors, and other insurance data, machine learning models can help to predict the approximate revenue that a particular customer can generate for a company over their partnership. Based on this information, the company can up-sell or cross-sell by reaching out to these customers with personalized products and services.

VahanBima is a leading provider of insurance services in India. The company predicts CLV using a linear regression algorithm and then uses the model results to allocate resources better and target customers with 100% personalized experience offers.

Next to predicting the customer’s profitability, insurance businesses can also use machine learning to forecast the likelihood of particular customer behavior — for instance, their maintenance of the policies or refusal. Based on these insights, companies can then update their business strategy.

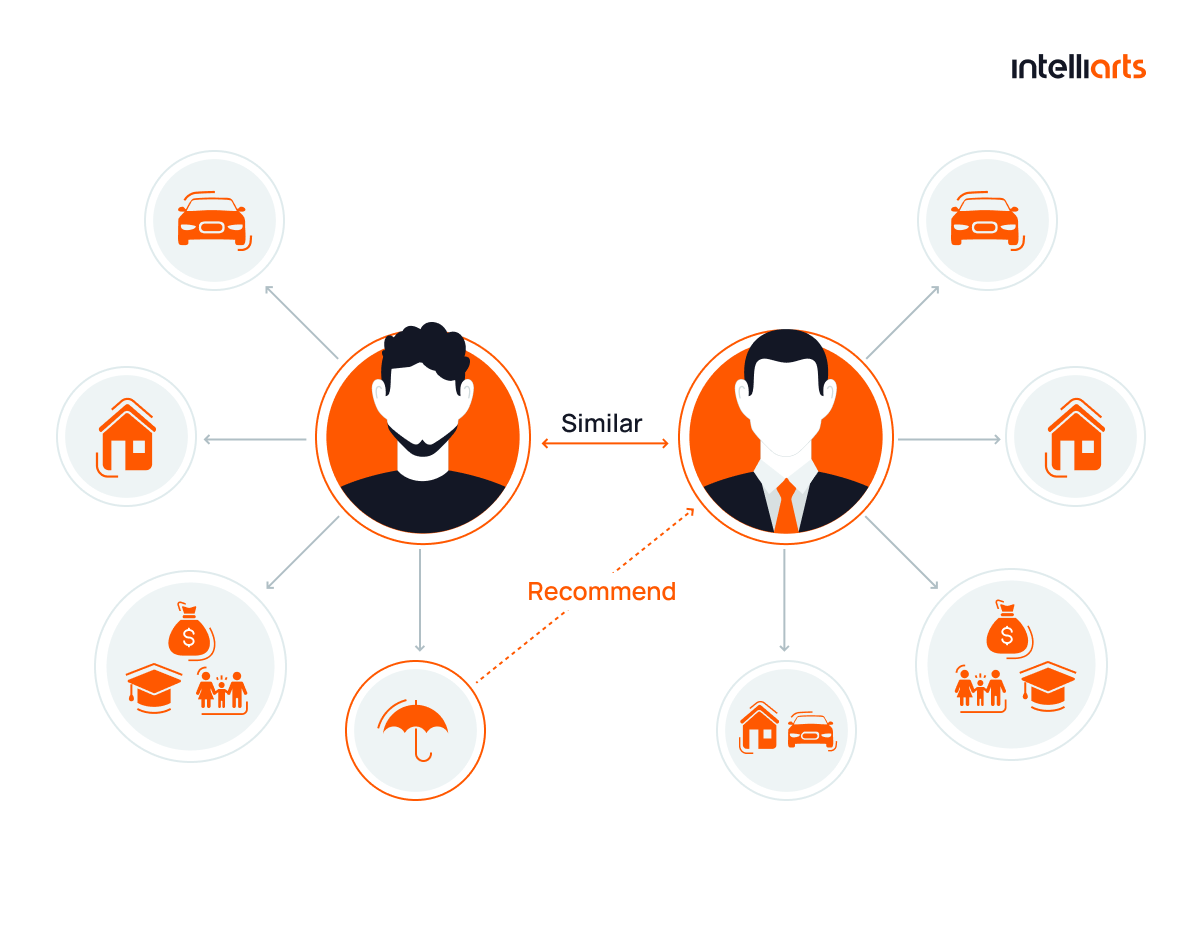

Insurance product recommendations

Product/policy recommendations are one more great AI application in insurance. Based on volumes of historical data, AI algorithms can analyze customer profiles and provide the most suitable policy offers out of those available, which will raise the chance of a successful sale.

An interesting approach is to use collaborative filtering. This means that an ML system suggests a product to customers based on their similar risk profile and/or purchase history to other customers who have bought this product earlier.

Lapse management

In insurance landscapes, a lapse occurs whenever the customer stops paying the premium, and the contractual grace period expires. ML can help to predict those policies at risk of expiring or terminating. This way, insurance agents will have enough time to interfere and talk to clients about the reasons for unpaid premiums and negotiate terms of payment.

Another benefit here is the ability to segment customers based on the lapse risk. So insurance companies can use the factor of solvency when issuing policies.

Automated inspections

Car insurance companies can benefit from computer vision and automated damage inspections. With AI-based image processing, a customer can upload a photo of the damaged parts of the car, and the system processes the photo automatically. On the way out, both the insurer and the customer receive a detailed report covering which parts are replaceable and repairable (and which are not), together with the approximate estimate for the repair.

Intelliarts built a car damage detection solution, which is composed of two separate AI models. One of them indicates the damage, and the other identifies the affected parts. The outcomes are then compared against similar cases in a prepared image database to provide the customer with repair cost estimates.

Property risk assessments

Computer vision technology can come in handy to property insurance companies too. This innovative approach allows for the automated extraction of valuable information from images to help insurers with the assessment of property conditions, damages, and maintenance needs.

By interpreting visual data, computer vision systems provide home insurers with a more comprehensive and objective view of a property’s state. Companies can then use these insights to enable more efficient and faster property risk assessments.

Chatbots

If we’re speaking about customer service again, chatbots and AI-based virtual assistants are of great help in insurance, facilitating customer interactions, answering queries, guiding users through the tricky claims processes, etc. These help to enhance customer experience by providing real-time responses, automating routine tasks, and improving overall efficiency in handling insurance-related inquiries.

A prolific example is the use of TextQBE by QBE North America, a global insurance leader. This AI-powered virtual assistant helps the company answer simple questions from customers about deductibles and process photos of receipts and other documents. Eric Sanders, senior vice president of QBE North America, recognizes this intelligent conversion platform as a great way to take their customer experience to the next level:

Customer satisfaction scores through the service have averaged 4.6 out of 5 – many with comments such as ‘great customer service, fast and friendly,” answered all my questions.

Intelliarts has lots of experience with ChatGPT and other LLM chatbot development. Read this case study on a data extraction solution based on ChatGPT to get more details.

Employee training

Training employees is a crucial element for insurance companies to establish a reliable workforce within the organization. It can also become one more interesting AI use case in insurance.

By using AI in employee training, insurers can benefit from:

- A more personalized learning experience, which takes into account the job role, skill level, and learning style of employees

- Fast delivery of information and more custom content like the use of videos or one-to-one communication, which together reinforce the user’s learning goals

- Ability to translate training materials into multiple languages

- Personalized assessment techniques

- Automated feedback, with areas of excellence and improvement

- Opportunities to learn outside of their workplace

Machine learning in various insurance domains

While we covered applications of machine learning in insurance generally, it’s also interesting to explore how ML is improving the insurer’s bottom line and the customer experience in specific domains.

Health insurance

This is probably the most progressive domain in the insurance business. So no wonder health insurance companies exploit disruptive technologies and machine learning a lot. ML systems mostly help them to identify at-risk individuals and decrease rising costs in the field.

Since an ML model can look at and extract patterns from millions of data points at once, it provides custom recommendations and insurance packages to create a robust user experience in the domain. With the help of ML, Accolade offers personalized insurance services and helps patients choose the most relevant and cost-effective health coverage. Now the company reportedly has over 1.1 million customers.

Property and casualty insurance

Personalized customer experience, as well as improved level of customer satisfaction, also explains the use of ML solutions in property and casualty insurance (P&C). Statistics show that 84% of insurance organizations have introduced or are planning to introduce ML for this purpose. Based on customer historical data, ML algorithms help P&C insurance carriers target customers with more personalized plans tailored to their needs and not to waste time on prospects with low conversion rates.

Another common use case in P&C insurance includes computer vision. This technology allows analyzing property quickly, accurately, and without extra effort when the claim is filed. The investigator doesn’t need to go to the field. Besides, the insurer can suggest upselling when it notices new structures added to the property, such as a garage or a swimming pool.

Auto insurance

The standard use cases of ML in auto insurance include claim processing, intelligent underwriting, and fraud detection. Still, we can also mention more interesting applications, such as the use of ML and computer vision for damage estimation, calculating repair costs, and analyzing the impact of the accident on the driver’s future premiums.

For example, Liberty Mutual is using an ML-based mobile app, where their customers involved in car accidents can upload photos of their damaged car right at the crash site. Trained with thousands of car accident images, the ML model will automatically calculate repair costs. In real time, the customer can also settle a claim using the same app.

Life insurance

Many businesses that underwrite life insurance find ML algorithms useful in risk prediction and optimizing prices. In this scenario, the technology has a high potential to automate and speed up the evaluation process. It also has access to wider data sources and can base predictions on more variables, such as mortality statistics in the region.

A life insurance application is treated as a standard problem of supervised learning in insurance, where

- The application acts as a data point

- The information (or data columns) provided by the customer are the features of this data point

- The risk rating of the customer is the output the insurer is aiming to predict

Aside from underwriting, machine learning in life insurance can be applied in churn prediction, personalized marketing, and lead management. Also, they might employ top large language models to revolutionize customer interaction and service personalization.

Steps to implement ML in the insurance business

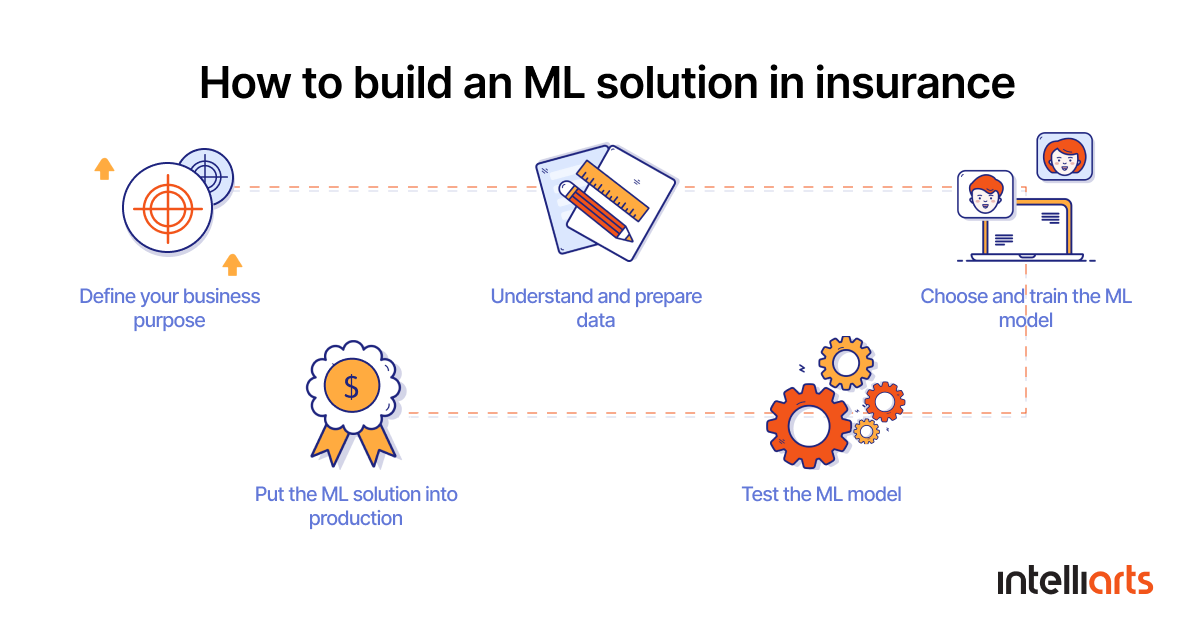

1. Define your business purpose

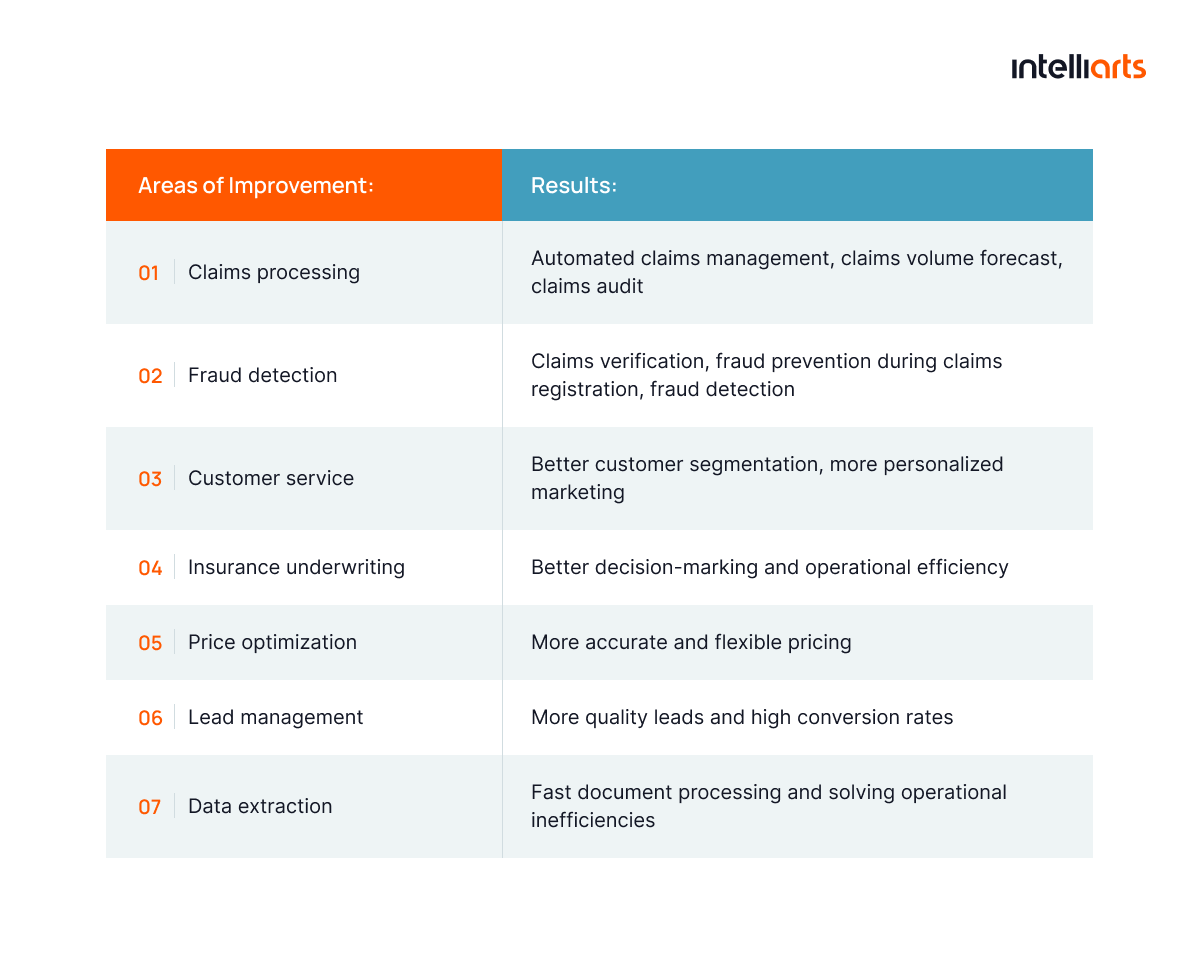

A good idea for getting started with ML is to consider what business tasks you need it for. Earlier we mentioned 7 key use cases – go through them and think about which are relevant to your company. Then, prioritize the tasks based on your biggest pain points and those that are only nice to have.

Try to be as specific in your objectives as possible. You can also seek the consultation of professional data engineers who have industry expertise in insurance. For instance, we as Intelliarts always start from business understanding before moving to any custom solution development. So, we can help to understand the roadblocks in your insurance business efficiency and those processes that can be optimized with the help of ML.

2. Understand and prepare data

Getting quality and enough data is a top priority for building a reliable ML solution. Under the supervision of expert data scientists, you identify and understand the data you own now or need to collect in the future.

Most insurance companies have repositories of existing data (think about your historical claims data or policy data). Even if you don’t have enough raw data, a professional ML team can assist you with data collection, advising on the best types of data, formats, or ways of storage. Data engineers can also back up your business with synthetic data if needed.

For those interested in data collecting and contributing to this crucial phase of the process, there are abundant opportunities on Jooble to explore.

After data collection, data scientists will also need to invest time in data exploration to find patterns in data, investigate relationships between variables, and determine how these will affect the outcome. Data visualization can be really helpful at this stage. Also, data cleansing and validation, as well as data structuring, may be needed to process the data the most efficiently.

3. Choose and train the ML model

This is when the ML model is actually being built. Data scientists need to explore different ML algorithms and choose the ones most suitable for your business problem. Then, these algorithms are trained — the model is fed with training datasets, the results are evaluated, and engineers fine-tune model parameters until they get high accuracy.

4. Test the ML model

Testing is a critical step in building an ML-powered solution. Here data engineers under the guidance of the insurance company check whether the ML system works as planned and whether the results are satisfying enough (maybe the model needs more training).

5. Put the ML solution into production

When the ML model is ready, data engineers can move to machine learning deployment in insurance. Ideally, the ML team should also assist with model monitoring so you can track the results without diving deeper into the technical details. With decent model monitoring, your insurance company will also know when the model needs retraining in case you get new datasets.

What’s the future of ML in insurance?

Insurance is a highly competitive industry, especially now when many companies are operating online. A good way for an insurance company to stand out in the competition is to use the benefits of innovative technologies and machine learning in business, in particular.

ML algorithms have a good chance to transform the frustrating experience of insurers’ customers from inefficient and time-consuming services to automatic, fast, and more affordable. The insurers of the future (and you can become one of them easily) are getting value from the abundant insurance data they’re sitting on and use ML to:

- Increase underwriters’ efficiency

- Handle claims faster and in a more productive way

- Detect fraudsters in a few minutes

- Predict potential churners and take measures to retain customers

- Analyze leads more effectively and choose the most promising ones

- Extract valuable insights about their customers to apply personalized marketing tactics

- Segment customers to target them better

- Extract data easily

- Optimize premiums and adjust them dynamically to market changes

Intelliarts as your ML partner in insurance industry

Intelliarts combines vast expertise in insurance software development, machine learning and domain knowledge of the insurance industry. We provide technology consulting services, including AI consultation where we can assess your readiness and prepare a detailed roadmap for adopting ML into your processes. Our data science team could then help you with ML implementation.

Our portfolio counts a range of success stories in the insurance domain. Among those most interesting projects, we can mention:

- Improving cold calling success rates for property and car insurance company

- ML-powered solution to increase lead quality and agent efficiency for insurtech

- Predictive lead scoring model for insurance

Want to get started with machine learning in insurance? Or maybe optimize your existing ML system? Contact our talented ML engineering team, and we will gladly help you improve your business operations.

Wrap up

In the last decade, the insurance sector has produced and accumulated as much data as ever before. The bad news is that insurers use not more than 10-15% of this data, according to the Accenture study. Unlocking this potential requires building robust data pipelines to efficiently ingest, process, and analyze the vast amounts of data at their disposal.

Using machine learning can help insurers use the data to which they have access to its fullest potential and improve their business in a range of ways, from fraud detection to risk mitigation to claims processing and price optimization.

FAQ

How can machine learning be used in the insurance industry?

There are many use cases for machine learning in the insurance industry, from automated claims processing to fraud detection, price optimization, and automated risk assessment.

What are the major challenges for insurance companies when it comes to machine learning?

When deciding to go with machine learning, insurance companies may meet the problems of disparate data and data silos; low data quality; or the lack of data. All these can be handled under the guidance of experienced data scientists. Another problem that can arise is the lack of ML expertise, which may be solved by outsourcing ML implementation to a reliable vendor.

What is the role of machine learning in insurance?

ML development solutions can bring lots of value to insurance companies. For example, it can help with predicting trends and, hence, better decision-making and cost optimization. Another benefit includes increased customer loyalty thanks to faster and more quality services delivered. Insurers can achieve these via automated claims processing, personalization, and more accurate underwriting services.