It takes a lot of time and effort to perform an assessment for a risk analyst. The process involves researching and analyzing numerous factors to evaluate the risks a potential customer might undergo. Moreover, because of the subjectivity of this process, various risk analysts frequently provide diverse assessments for the same policy.

However, machine learning can help to evolve the risk assessment process by creating risk models that process the information stored about previous policies to learn from previous mistakes and successes, which results in evaluating newly signed ones more quickly and reliably.

In this way, machine learning for risk analysis benefits both sides: businesses and customers. ML solutions allow insurance companies to reduce the time of evaluation and encourage employees to spend free time on other important tasks, like improving customer service. From the perspective of customers, they receive better services and more suitable products as a consequence.

With machine learning technology in insurance, companies are freed from numerous repeatable and time-consuming tasks, as after the initial ML model is trained and a necessary ML pipeline is set up, it continues to educate itself, finding ways to make better predictions over time.

Traditional risk assessment vs. Machine Learning-based

The traditional approach to risk assessment is a valid method of conducting this practice, but the adoption of the ML-based approach has benefits that provide insurers with a competitive advantage. Compared to traditional, machine learning in risk assessment tends to be more effective due to several reasons:

-

The process can be automated for quicker application processing.

-

Machine learning models can deal with large datasets, the more information a data set contains the more “experienced” AI becomes. In fact, the abundance of information an ML model can operate may exceed the amount of information a human can understand and analyze in a reasonable amount of time.

-

Constant developments in data analytics create even more favorable conditions for data processing and increase the chances of achieving very high precision of ML models.

-

ML algorithms enable faster decision-making while being a fully automated process, or in some cases involve human insurers at later stages to make the final decision.

-

ML-powered risk assessment provides customers with more privacy because as a rule sensitive data is protected with multi-factor authentication, and all personally identifiable information is encoded before being fed into the ML algorithm.

Now, let us look at the benefits of machine learning risk analysis in insurance.

The benefits of Machine Learning based insurance risk assessment

Advanced risk assessment

Insurance providers are forced to maintain a strict balance with regard to underwriting policies. On one hand, it has to be an attractive deal for the customer. On the other one, it has also to bring profit for the insurer.

ML-based systems help risk managers to achieve complete risk visibility by combining the data required for standard risk assessment with unstructured data from reliable public sources, third-party information, social media, and news feeds. Having collected everything above, it communicates a thorough risk profile to the underwriters in a way that is very easy to understand.

This allows for conducting highly precise calculations and a 360-degree approach that enhances the overall process, which is a great benefit both for insurers and customers. The fact is that the abundance of data is an advantage for those who employ it.

Sometimes, it is even impossible for a risk analyst to calculate the total amount of risk associated with a customer, especially a legal entity. For example, it would be unmanageable for humans to fully understand the risk exposure of an enterprise’s IT systems and to translate those risks into financially advantageous insurance policies effectively.

Fair pricing

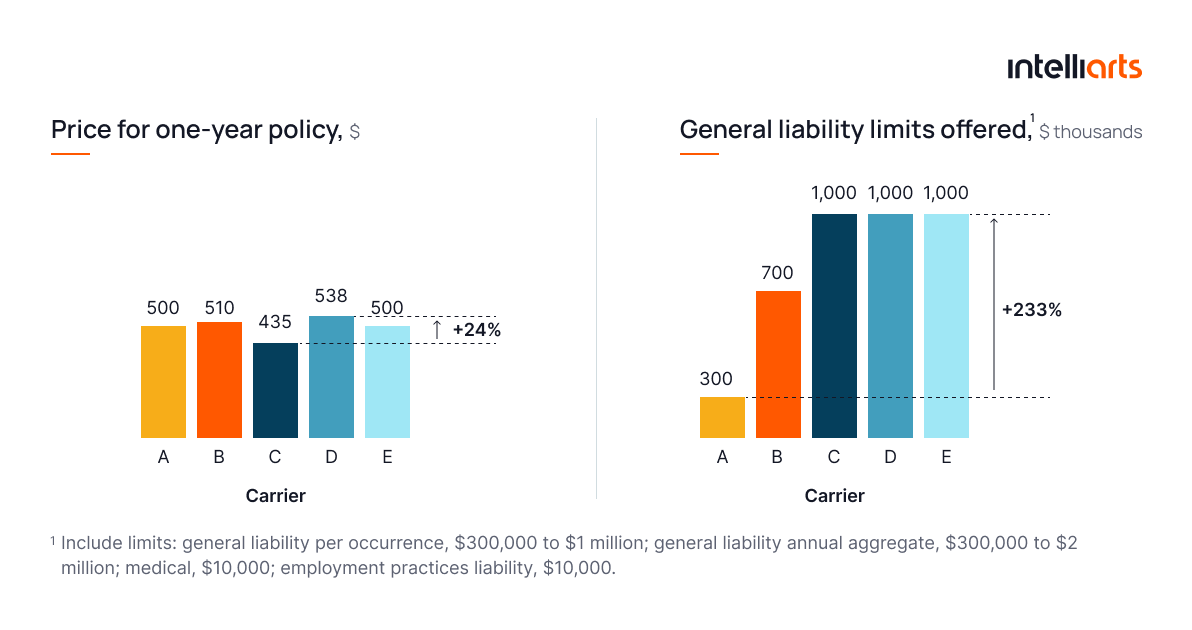

With the traditional approach, the same risk can be estimated differently by various insurance vendors due to the subjectivity of risk analysts. A prominent example would be a McKinsey study that describes a case in P&C insurance, in which five different insurance companies estimated one customer with price fluctuating by 24% and coverage amounts by 233%.

It is no doubt that there are highly-professional risk analysts who deliver valuable results, but when it comes to the improvement of the whole company, machine learning-based risk analysis is the technology that should improve existing results.

The machine learning approach to risk assessment in insurance can conduct highly-precise calculations, as geopolitical risks, real-time IoT data, social media information, and 3rd party data might be considered. Moreover, all of them are a part of a price-generation process.

On the other hand, technical pricing often results in under- or overpriced policies. To avoid this situation, insurance companies sometimes readjust the prices for their policies to make them either more affordable or more profitable whenever there is a need. Price readjustment may become a successful business tool, but still, the technical price remains an important benchmark for it.

Improved customer experience

Another benefit of an ML-based risk assessment is its ability to make the service convenient and useful for customers.

Machine learning model implementation requires a large dataset with enough data for precise calculations. This data set is a valuable asset itself because it contains information about the customers’ interests, which might give you an insight into how to interact with them and what to offer.

Sometimes, it is even possible to motivate customers to reduce the risks associated with their insurance. For instance, John Hancock offered their customers fitness trackers to share their health info with an insurance company. One of the conditions was that the customers were rewarded for sticking to a healthy diet and having an active lifestyle.

The fact is that such IoT devices and these terms motivated people to have almost 5 more active days in a month on average. Furthermore, the collected data suggested that those customers increased their lifespan by 13 to 21 years.

New up-sell and cross-sell opportunities

Better precision of AI-based risk assessment allows for advanced solutions in up-selling and cross-selling.

If a customer has a low-risk profile, there is a low probability that an insurance case will take place. As a consequence, it is doubtful that the insurance company will have to cover or compensate for a policy event. In this case, there is a cross-sell opportunity because an insurer can offer to add more benefits at a lower price to the customer’s premium.

Another benefit of AI in insurance is that it can easily operate large amounts of your customers’ data, and the more you have digital systems available, the greater results you can achieve by making them work in unity. The goal is to transform your data into knowledge to allow extracting new insights from it.

For instance, an ML model can gather information from the chatbot and other platforms, through which a customer tries to reach out to the insurer. As a consequence, everything written or said by the customer can help to estimate the financial situation and the needs of the customer to be later included in a highly customized and flexible offer that would bring the maximum benefit to both sides.

How to implement ML-based insurance risk assessment?

With many other insurance use cases of machine learning, risk assessment requires preparation to be done in advance to be implemented properly. There is basically a set of the common high-level steps required for successful machine learning solution implementation, which can later be customized or enhanced, based on the specific business case:

-

Plan the strategy to support the ML-based system beforehand.

-

Inform current employees who take care of risk analysis about all the benefits and possibilities of an ML-based approach. Highlight the fact that people will not be replaced but rather educated to benefit from technology.

-

Readjust the workflow so that the risk assessment process remains or becomes seamless.

-

Train ML models to assess the risks, create the best offers and optimize prices.

-

Monitor any anomalies in the behavior of ML so that the model could be retrained if data changes or data shift is identified.

-

In case the quality of precision drops, contact your ML engineers to perform any necessary changes.

Once again: artificial intelligence is not something that will replace human risk analysts. In order to make the most out of it, the company should combine the input of both: a human and AI. While the machine can help with risk selection and pricing, an insurance company still needs experts with a set of hard and soft skills, an awareness of the market, and a vision of industry performance in the nearest future.

How much does automated risk assessment implementation cost?

The price of a machine learning risk assessment solution depends on multiple different factors. If you are going to plan the budget for such a project, it would be important to begin by deciding on high-level choices. Our suggestion would be the choice of how to obtain an ML solution. Here are the three most commonly used options.

Existing solution

This one is the quickest solution because most of the work is already done. However, buying an existing solution might still require engineering efforts to integrate it into the company’s products ecosystem. Besides, while such software tends to be universal, it may lack some of the requirements of your project or the customization needed to implement the necessary features like the choice of data for the model’s training.

In-house data science team

Not every insurance company has an in-house team of ML developers, and onboarding one is a time-consuming and expensive process. On the other hand, the choice to have your own team of developers is the best long-term strategy for those who can afford it and find it reasonable to have one. Remember that the team of professionals will also require new tasks after the work with the ML risk assessment system is done.

Technology partner

One of the alternatives is to find a technology partner that could perform research, decide on system requirements together with you, and then build a custom solution. In this case, you should choose a reliable software vendor who is aimed at the delivery of a working solution rather than just writing code. A good software development team will act more like a business partner who can advise you on different issues based on their experience and would take responsibility for the solutions they implement.

The future of Artificial Intelligence based risk assessment

All of the technologies and approaches described above are already available. However, it would also be important to consider the current trends and analyze how they may influence the development of the insurance industry in the future.

One of the factors that will shape the future of insurance is the ever-growing amount of data. The fact is that various devices are estimated to generate even more data than we already have. To understand the scale of data growth, it is important to know that the overall amount of data possessed by humanity doubles every two years.

The more data you have, the harder it is to handle it with the traditional approach. As for the ML approach, with the growth of data, your model becomes more precise and gets new capabilities. Besides, it is vital for modern companies to utilize new technologies in order to keep pace and stay ahead of the competition. Therefore, ML-based solutions will become even more useful in the future.

Conclusion

Risk assessment using machine learning in insurance is much more advantageous than its traditional analog due to the:

-

better precision,

-

greater speed of processing the information,

-

and discovery of additional insights.

As a consequence, ML integration gives insurers a competitive advantage since more accurate risk analysis in insurance helps to avoid financial losses. As for quicker data processing, it saves time for the insurers who can spend time on other tasks, and for the customers who are used to and demand quicker services. Finally, any new insights are the source for the ideas for further improvements.

Applications of machine learning in business change the way insurance companies operate, adding more capabilities for making their product more profitable as well as more convenient for their customers. In this scenario, traditional insurance companies run the risk of being overtaken by the born-digital insurtech companies, and therefore, they simply have to evolve and go digital.

There are strong tendencies toward the growth of the amount of data, the need to be able to operate, and the competitive ML benefits of those insurance companies that adopted AI technology. Therefore, these tendencies suggest that insurtech businesses will benefit even more from ML in the future.

While the traditional approach can achieve the tasks of risk assessment, ML technology allows employing more of your insurance data to achieve better results. Here at Intelliarts, we understand the challenges of digital transformation, and our team will be ready to help along the whole process. You can find a description of our case studies on the Intelliarts DesignRush profile.

Our data scientists always start with a detailed analysis of your data in order to offer the best possible solution for your specific business case. After the project delivery, we help to educate your professionals on how to use it as well as we remain in touch to be able to retrain the model or make other necessary adjustments.

FAQ

1. What are the benefits of using machine learning?

Machine learning can provide lots of benefits to your company, from reduced customer churn to more informed decisions, process automation, and better customer experiences via personalization.

2. How to implement ML-based insurance risk assessment?

Implementing an ML-based risk assessment system consists of the same stages as building any other ML-powered solution. Precisely, we start with business understanding to get a grasp of the project’s goals and requirements. Then, we move to data understanding and preparation. At the stage of modeling, we choose and apply the appropriate techniques to build an ML risk assessment solution. Finally, the team evaluates and deploys the solution.

3. How is machine learning used in risk management?

There are several applications of ML in risk management. By automating risk scoring, ML can improve decision-making, i.e. your decisions will be made faster. It also increases accuracy in risk management — the more and better data the company uses to train the model, the more precise results it gets.