For an insurance company, signing a new contract is only half the battle. Then go customer retention and loyalty, which are challenging to build but necessary for the long-term success of the company.

Customer churn analysis in insurance can have a great impact on the insurer’s bottom line. A 5% monthly churn rate might sound pretty innocent to some people. Yet, compounded yearly, the insurance business may reveal that it’s losing a significant amount of its policyholders.

That’s why reducing customer churn rates is worth prioritizing, and the most reliable way to do it is by applying machine learning in insurance. In this article, we will walk you through customer churn prediction in insurance with the help of machine learning technology, discuss its opportunities and stages of implementation.

Top 3 reasons of churning in insurance

Well, churn is not good. But what are the specific negative effects of customer churn on the insurer’s performance?

Financial burden

A heavy financial burden caused by churn results in lost revenue. It also puts extra pressure on the team that has to make up for the reduced income, and the only way to accomplish this is to engage and acquire new customers. At the same time, Forbes warns businesses that winning a new customer usually costs five times more than retaining the existing one.

Customer service

An insurance churn rate can also tell you a lot about the quality of customer service. The PwC survey proved that even the most loyal customers are not ready to tolerate the brand if they have had several bad customer experiences with the company. For example, churning in insurance can occur when policyholders leave due to unresolved claims issues or poor customer support interactions.

Read the related case study on how to improve customer service by enhancing cold calling effectiveness in insurance.

Growth potential

Finally, customer churn is a great indicator of the insurer’s growth potential. The company can compare its churn rate to the growth rate (the number of new customers) and see whether it’s moving in the right direction. If churn is becoming higher than the growth rate, it’s a red flag for an insurer to review its retention strategy.

Strategies to prevent customer churn

Preventing customer churn is crucial in the insurance industry, where competition is fierce and customer loyalty is hard to maintain. Here are the top five strategies to prevent customer churn in insurance:

Double the effort on customer engagement

Regularly engage with your customers through meaningful and value-driven communication. A good practice is to reach out to your policyholders before they actually need you to prove that you’re invested in helping them get the most value out of your insurance services. By utilizing cloud recruiting software, you can hire more employees who will deal with customer engagement, ensuring that your outreach efforts are always on target.

Among other practices, you can send also your customers personalized policy updates, renewal reminders, and educational content that helps to make informed decisions. Creating a sense of community through events, webinars, and loyalty programs can also foster a stronger connection with your company.

Never ignore customer complaints

Did you know that 62% of businesses do not respond to customer service emails? And it’s a big mistake on their part as they lose an opportunity to address issues, ultimately leading to customer churn. And complaints are often just the tip of the iceberg, suggesting that larger, hidden problems exist.

What’s more, only 1 in 25 unhappy customers will actually complain to you — the rest will simply leave. So it’s crucial to value those customers who share their negative experiences and respond to their needs fast. Consider a policyholder who has trouble with a claim process. If their complaint is ignored, they are likely to switch to another insurer and spread negative feedback to others.

By taking complaints seriously and acting on them promptly, you can prevent customer churn. This way, you not only resolve immediate concerns but also show customers that you value their feedback. Satisfied customers whose complaints are handled effectively are more likely to remain loyal and even become advocates for your company.

Offer strategic incentives

Rewarding loyal customers with tailored incentives, such as discounts or promotional offers, can significantly enhance engagement and retention. A survey found that 64% of customers significantly increase their spending thanks to membership in loyalty programs. Among different incentives to choose from, discounts or promotional rates as policyholders approach contract renewals work best in insurance.

Target the right audience

No matter the sophistication of your retention strategies, they risk falling short if you’re attracting the wrong audience. Emphasizing “free” and “cheap” offers in your initial interactions risks drawing in policyholders who prioritize short-term savings over comprehensive coverage and long-term value. These bargain hunters are often the first to leave when they find a slightly better deal.

Instead, shift your focus to those who appreciate the lasting benefits and quality of your insurance products. As Sunil Gupta, a professor at Harvard Business School, puts it:

“If I offer an incentive to customers most likely to churn, they may not leave the company, but will it be profitable for me? The traditional method is focused on reducing churn, but we contend the goal should be maximizing profits, rather than only reducing churn.”

Proactively seek customer feedback

Setting up a customer feedback loop can be straightforward, such as deploying customer satisfaction surveys or feedback forms via email or on your website. These tools demonstrate your commitment to continuous improvement and show customers that their opinions matter to your company.

Regularly ask for feedback from policyholders to refine your insurance services based on the customer experiences. For example, you can survey your customers to gather insights about claims processing, policy clarity, and overall customer satisfaction. Also, touch on those topics that usually become a prerequisite for customer churn such as unclear policy terms or inadequate support during claim settlements.

All the strategies mentioned above exemplify a proactive approach, where insurers take measures before the customer actually leaves the company. Surprisingly, many insurers still adopt a reactive approach to managing customer churn. This involves making changes and adjustments to their strategy and analyzing the outcomes at the end of the month, calculating the churn rate.

In reality, a proactive strategy proves more efficient in preventing churn because it allows insurers to anticipate and address issues before they escalate, thereby fostering stronger customer relationships and enhancing overall retention rates.

Another great proactive strategy is to predict customer churn in insurance using machine learning. So let’s talk about the steps for how to build a customer churn model.

Implementing machine learning for customer churn prediction

1. Goal definition

Before an insurance company moves forward with building an ML solution, it should understand its existing problem and define the insights it wants to get from the analysis, i.e. the main goal. For instance, data scientists that the company will work with will need this information to understand what type of ML problem they are going to solve: classification or regression.

Although this might sound complicated a bit, here’s an explanation:

-

Classification is to define to which class or category a data point (or a policy keeper in our case) belongs to. In basic understanding, an ML algorithm will be trained to divide customers into churners and non-churners and answer questions like “Will the customer leave the company?” “Renew the insurance policy?” “Downgrade it?” A specific type of classification problem called anomaly detection can also help insurers track atypical behavior patterns of their customers.

-

Regression aims to evaluate the relationship between the variable and data values that influence it. In simple words, the outcome of regression always includes a number, for example, the period when the customer is projected to leave the company. In the case of classification, it’s always a suggested category (churner/non-churner).

2. Data collection

The next step will be to decide what sources to use for data collection and actually gather this data. In machine learning, data matters a lot, and the quality and relevance of the insurer’s data will directly impact the results that the ML model produces. Some of the sources that insurance companies could consider include:

-

Types of policies held

-

Demographic information

-

Data related to customers’ locations

-

Sales and customer support records and call transcripts

-

Customer reviews on social media or review platforms

-

All types of feedback provided by customers on request (surveys, follow-up emails, and so on)

If you don’t have enough historical data or you’re not sure which sources to choose, no need to worry. Intelliarts’ data scientists have enough expertise to help you with data collection.

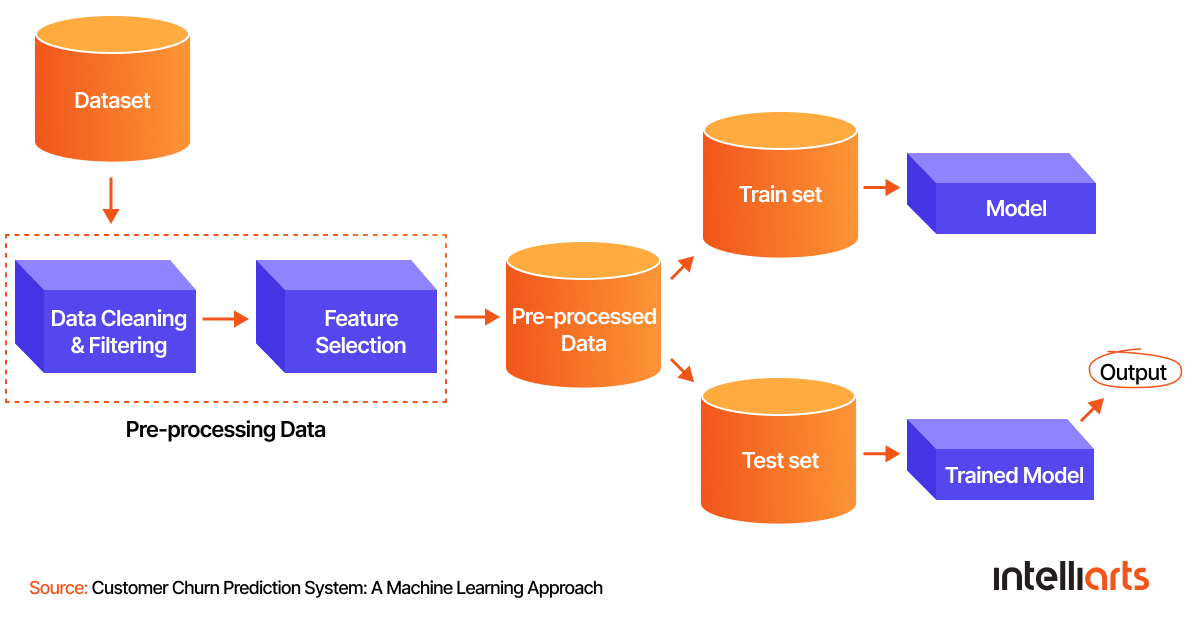

3. Data preparation and preprocessing

Data scientists will also need to prepare the raw data and convert them into a suitable format for an ML system to digest. To put it differently, the data points should be structured according to the same logic, and data scientists have to get rid of any inconsistencies.

The process of preprocessing could include these techniques:

-

As its name suggests, feature extraction helps to leave out the most discriminative and irrelevant information and, thus, shorten the number of variables, i.e. attributes, that impact the final results in machine learning.

-

Feature engineering means determining a set of features that describe the relationship between the customer and the service provided. In other words, these features have to describe the observations that ML algorithms will base on to predict customer churn probability. For example, this could be the division by age (younger vs. older) or the division of the cost of insurance by the average user’s salary.

-

Finally, the idea of feature selection is to revise all the extracted features and choose only those that correlate with customer churn the most. This is how data scientists get a dataset with the most relevant features.

4. Modeling and testing

The core of this project is the actual development of a churn prediction model. Data scientists usually test several models before they make their final decision. Also, building an ML model always engages multiple iterations: specialists have to train the model, tune parameters, evaluate, and monitor performance. They stop only when they notice that the model makes the most accurate customer churn prediction based on the training data.

Here is the list of ML algorithms that are used for customer churn modeling the most commonly:

-

Logistic regression

-

Naive Bayes

-

Decision Trees

-

Random Forests

-

Support Vector Machines

-

Neural Networks

In case, you’d like to read about ML algorithms in detail, here are the posts covering traditional ML and deep learning techniques.

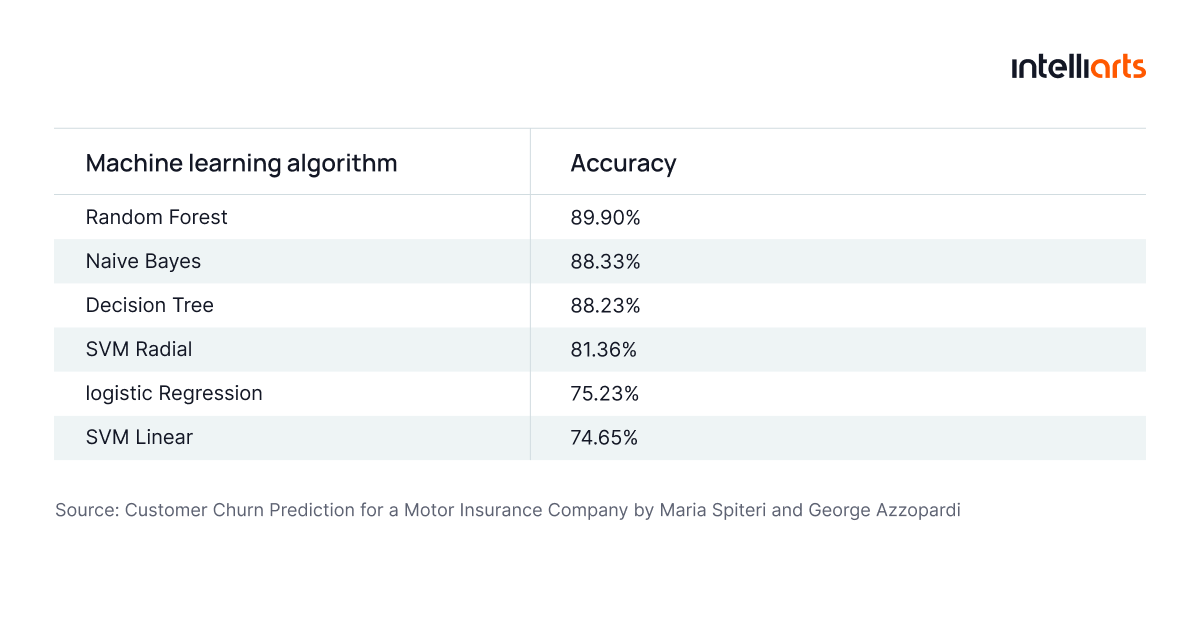

By the way, studies show different results on how various algorithms perform when it comes to customer churn prediction using machine learning. However, the research on the insurance industry proves neural networks as well as the random forest algorithm to be among the most effective ML techniques to use, with an accuracy of more than 90%.

Interesting results were also obtained with the use of the logistic regression technique. The case study on the major health insurer CZ proved that a logistic regression model predicted churn well. It also gave important insights into the correlation between specific variables and customer churn. The churn model tracked the relationship between churn rate and contact moment, the number of times insured, discounts, premiums, and so on. This information was valuable for sales and marketing departments for further customer retention.

5. Deployment and monitoring

The final step is to put the customer churn prediction model in production, which also means testing its performance and integrating it into the current system. However, data scientists should also regularly monitor the performance of the model and retrain it if needed, for example, in case of serious data changes.

Benefits of using ML for churn prediction

If insurers need a few more reasons for customer churn prediction using machine learning, review the next ones. ML technology is good for churn prediction because it can:

- Track at-risk customers: As said, machine learning risk assessment can help insurers analyze the behavior patterns of their policyholders and indicate the probability of churn. A company will be able to predict potential churners beforehand so as to interfere and reduce the overall probability of churn.

- Know your pain points: There are so many areas where an insurance company might need improvements, such as a long renewal process, affordability, or system errors. ML algorithms will help you track the most likely causes of customer churn so you can eliminate them and retain more customers.

- Optimize services: An insurer will also know what matters most to its customers and what they’re looking for in its services. The company could use these insights to improve its customer service.

- Increase profits: Churn prediction helps insurers retain customers better and, thus, prevent reductions in revenue. A company keeps its revenue streams at a steady level, which is good if we recall that retention is cheaper than customer acquisition. Furthermore, an insurer can use the obtained insights from its data to improve its cross-selling and upselling practices.

Read also: Automated claim processing by using ML

How to analyze customer churn in the insurance industry?

In insurance, customer churn refers to the situation where an existing customer stops using the services of the insurance company. A churn rate is usually measured in percentage, and one of the most popular ways to calculate it is to use the formula:

However, churn prediction via machine learning in a more efficient and faster way. Look at the customer churn analysis in the insurance industry with the help of ML:

1. Set your strategic goals and build a roadmap

Define precise business objectives for your machine learning project like whether you want to know only the percentage or number of churners and/or who the potential churners are and when they possibly could leave your company.

These will impact your implementation strategy as well as the way data scientists will build the solution like which algorithms to use. Based on these business goals, your insurance company should also create a long-term plan for progress monitoring and project result evaluation.

2. Enhance talent and infrastructure

The next step is to care about skills, technology, and insights that are necessary for building an ML-based customer churn model. This means building your in-house ML expertise by recruiting professionals directly or reaching out to a reliable external ML vendor.

3. Think about data security

Extensive data volumes employed in ML projects usually create an extra security concern for insurers. This is especially true if you consider that insurance data is often sensitive. So make sure to prioritize data safety by implementing additional security measures to mitigate risks of data breaches and leaks.

4. Start building the ML solution

Earlier we mentioned the steps of implementing an ML model to analyze customer churn in insurtech and insurance. Let’s list them once again: data collection, data preparation and processing, modeling, testing, deployment, and monitoring.

5. Make sure to update your customer churn model

Monitoring your model results is very important as there could be new data or changes in data, so your customer churn model will need to be updated. For instance, data scientists might need to re-train the model.

Machine learning for churn prediction use cases

The scholarly article “Case Studies in Applying Data Mining for Churn Analysis” tells about customer churn prediction using a decision trees learning model. In one case discussed, it was said that the model predicted 16 potential churners out of the 20 customers that eventually left the company.

Another study specializing in vehicle insurance titled “Predictive Churn Models in Vehicle Insurance” warns that precision and sensitivity in insurance churn prediction are more difficult to achieve as compared to, for example, telecommunication. An accuracy of 70% or more is still possible to gain, especially if auto insurers choose an artificial neural network.

A subscription-based insurance company noticed a considerable decline in the number of subscriptions. The insurer was still unable to detect the reason for increased rates of customer churn nor predict future churners. As a temporary solution, the company tried to use a range of generic customer re-engagement tactics such as surveys and email marketing, which yet proved ineffective in improving ROI. Without data-driven personalization, email marketing efforts often fail to address the specific behaviors driving customer churn.

After incorporating an ML-based model for churn prediction, the insurer obtained impressive results already in the next few months. The business was able to detect at least a fourth of churn customers. The marketing team then engaged in proactive campaigns months in advance and increased customer retention in general. The insurer saved as much as 3% of churn revenue per month.

In one more case study, the scholars aimed at predicting churn rate in insurance for a motor insurance company in order to provide insurers with an extra competitive edge against competitors. After using different machine learning algorithms, the researchers experimentally proved the random forest technique to be the most effective in this particular case (see the results below).

Spiteri and Azzopardi conducted a feature analysis to discover the most relevant features for modeling churn prediction in motor insurance. Other motor policies, a vehicle model, cover code and type, claim cost, etc. appeared among the most important features. Alternatively, features like an owner’s occupation or town, as well as policy duration, proved irrelevant. The researchers also performed survival analysis to model time until churn. They found that at least 90% of policyholders remain with the company for up to 5 years.

After all, fine-tuning the results, Spiteri and Azzopardi could reach an accuracy of 91% for the proposed customer churn model. This allows motor insurers to identify potential churners in advance and take measures for customer retention.

The real secret sauce for using ML in customer churn prediction for an insurance company is an opportunity to discover the hidden factors behind the insurer’s churn. ML algorithms can help to identify what’s specifically causing churn within your company, such as interactions with customers or the time factor, for example, after what period users stop using the service.

Reduce customer churn with machine learning

Customer churn is a big problem in the insurance industry, causing financial losses and lowering your growth potential. One great solution is to be proactive and predict customer churn using machine learning. In this case, an insurance company can react quickly and take measures to prevent appearing new churners.

In addition to reducing customer churn, machine learning can also significantly enhance insurance fraud detection, thereby safeguarding business finances and maintaining the integrity of insurance operations.

If you need a consultation on insurance software development or how ML techniques can help your insurance company prosper and reduce customer churn, drop us a line. Our team of professionals will be glad to dispel your doubts and discuss how a customer churn model will meet your specific business needs. Let us stop your customers from leaving, and by that – save up on retention costs.

FAQ

1. How do you predict when a customer will churn?

By using machine learning, of course. To build an ML-based churn prediction model, an insurance company should collect insurance data (spoiler: it’s likely you already have it). Then, define your goals like whether you want to know only the percentage of churners or who the potential churners are and when they’re going to leave the company. The next step is to hire a professional team to help you with the ML model implementation.

2. What is the best machine learning model for churn prediction?

A short answer: custom machine learning model, which will be built regarding the needs and workflows of your specific insurance company. (Intelliarts can help you to create a model like this.)

3. What types of data are used in customer churn prediction?

This could be all sorts of relevant historical data that the insurer can come up with. Try checking your insurance data like types of policies, demographic data, sales and customer support records, data related to customer locations, etc.