Both forecasting and asset management have always been data-intensive tasks. Considering the amount of information generated within the business environment tends to rise, conventional methods become ineffective. That’s when innovative technologies may come in handy.

In this post, we will delve into the concept of artificial intelligence in asset management, and find out what effect the adoption of the technology of intelligent forecasting and related practices will have on forecasting approaches in place. We’ll also discover the benefits of adopting intelligent forecasting in business and review potential challenges and recommended strategies.

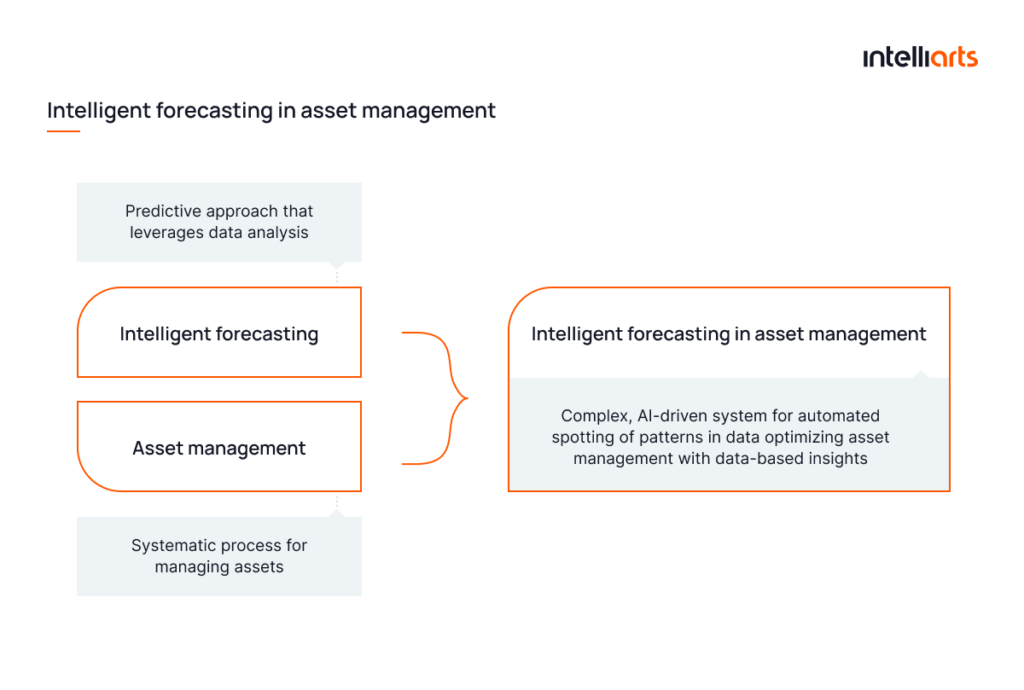

Intelligent forecasting and asset management: How they are connected

To begin with, let’s deepen into the concepts being discussed. Then, we will figure out how they boil down to a union of AI-driven technology and management methodology which can be applied to all businesses that deal with physical assets.

- Intelligent forecasting. A predictive approach that leverages data analysis methods and AI and ML technologies to process huge amounts of historical data and predict failures, trends and patterns.

- Asset management. The systematic process that helps to effectively acquire, store, operate, maintain, and sell assets to optimize returns.

Intelligent forecasting with artificial intelligence in asset management is conducted by applying advanced algorithms to vast financial data sets. Smart, AI-enabled technologies accurately anticipate market changes and spot patterns. It helps to generate insights that are helpful in optimizing resource allocation, mitigating potential risks, driving informed strategic decisions, etc.

The combination of AI and asset management propels business processes into the future of strategic, proactive decision-making.

What effect adoption of intelligent forecasting in asset management will have on practice

Conventional forecasting, which is still quite common, is often characterized by the following negative attributes:

- Extensive use of spreadsheets. They serve the purpose of collecting forecast data drawn from a limited number of internal sources.

- A number of analysts. Human analysts and analytical programs provide diverse forecast assumptions, often influenced by various biases. Another con is that the approach is resource-intensive.

- Difficult scenario modeling. Conventional processes make it overly time-consuming and data-intensive to change forecast assumptions when modeling real-life scenarios and putting them into use.

On the contrary, intelligent forecasting possesses such beneficial characteristics as:

- Improved forecast accuracy and timeliness

- Assumptions can be adjusted rapidly as new information is received

- No human bias affects the forecast

- A wide, diverse range of internal and external data sources are incorporated for a more holistic view of the business

- Visibility into causes of forecast variances

- Faster and more informed insights

Now, let’s get to know what concrete benefits the adoption of AI for asset management brings to businesses.

You may additionally discover a related matter — machine learning-based intelligent underwriting in our other article.

The business benefits of intelligent forecasting in asset management

Deriving from the previous section, intelligent forecasting applied in the area of asset management provides the following benefits:

- Effective and transparent decision-making. Using AI for asset management provides data-driven insights, empowering C-level executives to make informed and fully transparent strategic decisions.

- Optimized asset allocation. Predictive analysis ensures that resources are efficiently allocated, maximizing returns and portfolio diversity.

- Risk mitigation. Early detection of potential market volatility aids in the proactive management of risks to bear unnecessary expenses.

- Improved efficiency. Automation of complex reporting boosts the overall efficiency of management processes.

- Cost reduction. Minimized errors and reduced waste due to accurate forecasting lead to significant cost savings.

- Competitive advantage. Utilizing advanced forecasting tools allows for quick adaptation to market trends, giving a business a competitive edge.

Proper use of data generated through business operations is the key to success, and that’s exactly what artificial intelligence in asset management has to offer.

Should you need a trusted partner for integrating intelligent forecasting in your digital environment, don’t hesitate to reach out to engineers from Intelliarts.

Key strategies for implementing intelligent forecasting and asset management

Let’s proceed with reviewing some of the practices that accompany the adoption of AI in asset management.

Advanced analytics and machine learning

Then, cutting-edge analytics and AI models are built and deployed. They let you extract data, get insights from data, and create precise forecasts. Intelligent forecasting AI models help uncover underlying patterns in historical data and produce insights enabling effective asset management.

Real-time monitoring and adaptability

Real-time analytics can be implemented to instantly monitor the performance of ML models on data. Resulting systems adapt quickly to changes in data, ensuring the forecasts are accurate and up to date at all times.

Establish data collection and integration

According to the GIGO rule, the quality of forecasting output heavily depends on the quality of data. It’s crucial to initiate a reliable collection of relevant data from varied sources and ensure its seamless integration. In this case, types of historical data that come of usefulness are:

- Asset information

- Financial data

- Operational data

- Risk data

- Market data

- Environmental data

- Vendor/supplier Information

The formed database will be the foundation of the entire artificial intelligence forecasting.

You may be interested to know about data pipelines, components, types, and business use cases described in our other article.

Collaboration and cross-functional alignment

It often happens that the work of multiple departments depends on the results of intelligent forecasting with AI in asset management. Establishing a system that would share insights and exchange data between departments would foster high-level collaboration and cross-functional alignment.

Continuous evaluation and improvement

Naturally, all systems should undergo the process of constant modifications. It enables them to stay relevant in the high-paced technological environment. In that regard, establishing a regime of regular model performance evaluation for forecasting models and approaches is essential.

Intelliarts’ experience with intelligent forecasting

Here at Intelliarts, we specialize in ML technologies, including intelligent forecasting. Let’s take a look at two of the related cases, where we described how we successfully helped our customers achieve their business goals through the development.

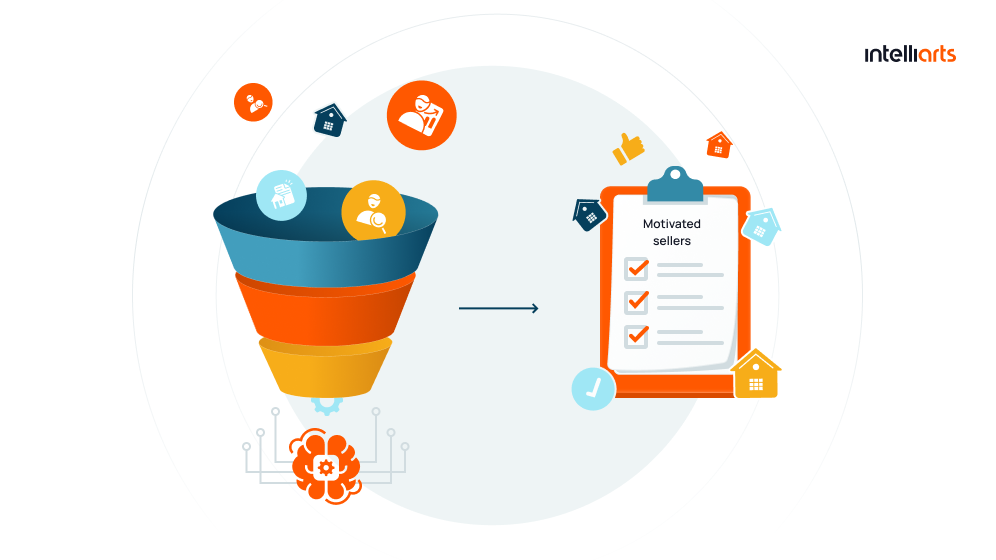

List stacking and predictive model for real estate businesses

The challenge was to predict homeowners who are likely to put their property for sale. This is expected to provide the business with a competitive advantage by enabling them to focus their efforts on the most motivated sellers.

The Intelliarts team built a realtor model — an intelligent forecasting model that can predict the probability of selling a house. We used a provided database that was over 11 TB in size for training and testing purposes. The accuracy of the resulting solution was over 70%, which is significantly higher than the industry standard.

Another model we built was the investor one. It can predict where there could be a discount agreed on a particular property. As for the project outcomes revealed after the solution deployment, the customer experienced an increase in revenue growth of more than 600% in 12 months.

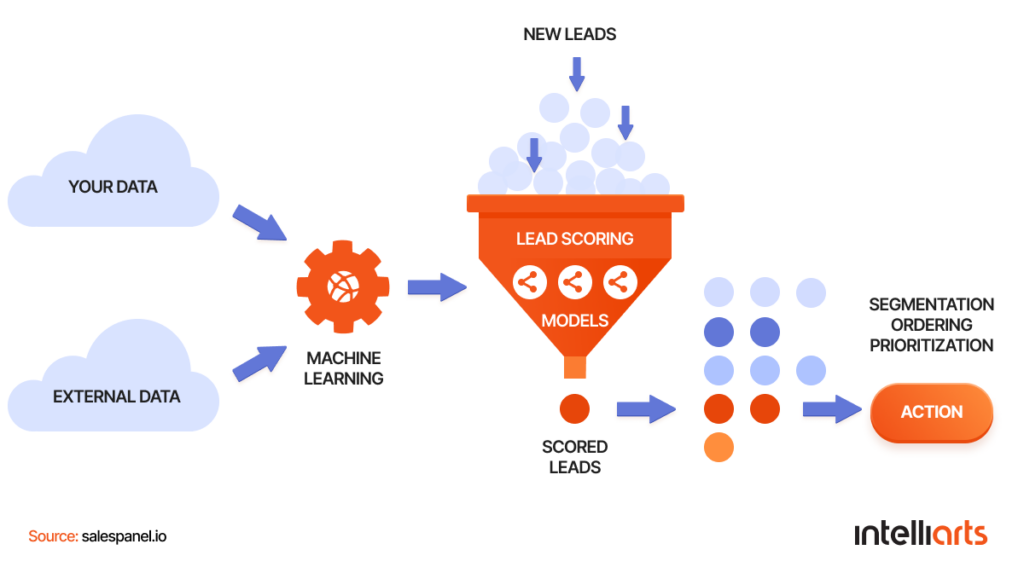

Predictive lead scoring

The challenge was to replace traditional lead scoring with a predictive lead scoring system. It should enable the insurance business to focus its efforts on potential customers who are more likely to purchase policies from the company.

The Intelliarts team ran a data collection process and built an ML scoring solution that can rank leads based on their probability of being converted to customers. The resulting intelligent forecasting model showed over 90% accuracy. In a few months after the deployment, the scoring prediction model started to cut off about 6% of all leads, resulting in a 1.5% to 2.5% increase in profit for the customer.

You may be interested to know additional details about predictive lead scoring and its benefits and use cases from our other article.

Challenges with the adoption of intelligent forecasting in asset management

Here are some of the needs business owners, managers, and executives should be aware of when considering the adoption of practices for AI & big data solutions in asset management in their digital environment:

- Adequate amounts of relevant historical data to train the model on

- Reliable access to data and a robust infrastructure

- Subject matter experts (SME) who can share business insights and help establish internal processes

- A supervisor who will validate intermediate project outcomes

Getting all the above mentioned in place before or at the beginning of partnering with an experienced ML service vendor will increase the chances of the project succeeding. All the technical challenges your service provider shall handle themselves.

Final take

The union of intelligent forecasting and asset management happens to result in a new, smart system for handling assets. Through the wise implementation of forecasting strategies and avoiding possible pitfalls successfully, a business can gain a huge boost to its operational efficiency. It brings better forecasting outcomes, resulting in higher revenue achieved through cost optimization.

Entrusting the integration of artificial intelligence in asset management systems to the industry-best experts would be the right call. With substantial experience in artificial intelligence forecasting, the Intelliarts team can offer you perfect-fit AI development services, raising the bar for your forecasting and asset management practices higher.

FAQ

Yes, the technology can be utilized in finance, healthcare, retail, manufacturing, and other industries. It helps businesses with predicting future trends, demands, and risks, and enhancing decision-making processes.

Such factors include the quality and volume of historical data, choice of accurate algorithms, incorporation of relevant variables, constant model refining, and organizational acceptance of AI-based predictions.

Such tools offer efficient demand prediction, cost savings through optimized inventory and operations, improved sales strategies, and better risk management driving growth and competitiveness.