Solution Highlights

- Created a predictive lead scoring solution that groups leads by the conversion probability

- Built a similar ML-based solution for prospect prediction

- Helped to increase the insurer’s profitability by 1.5% in a few months

- Removed any guesswork from lead scoring and prevented company resource wastage

- Raised the overall lead efficiency since the company chooses more quality leads now

About the Project

Customer:

Our customer (under NDA) is a midsize insurance company specializing in home and auto insurance. Today, its digital marketplace counts almost 50 top-rated home and auto carriers, along with distribution partners. Much of its success comes from a variety of lead sources, from telemarketing to a website page to collaboration with partners. Then, the customer reaches out to leads by cold calling.

Challenges & Project Goals:

The customer’s pain point was labor-intensive and restricted traditional lead scoring model. With a complex and non-linear sales funnel, the company spent too much time and resources on managing leads. What’s worse, not all leads they contacted were worth the effort — one day, an agent could spend 3 hours on a call to sell a policy while the other day, the same agent sold two or three policies during a 30-minute call.

So, the project’s main goal was to replace this inefficient system with a custom predictive lead-scoring solution. This should help the customer prioritize leads better, raise efficiency, and optimize the company’s resources.

Solution:

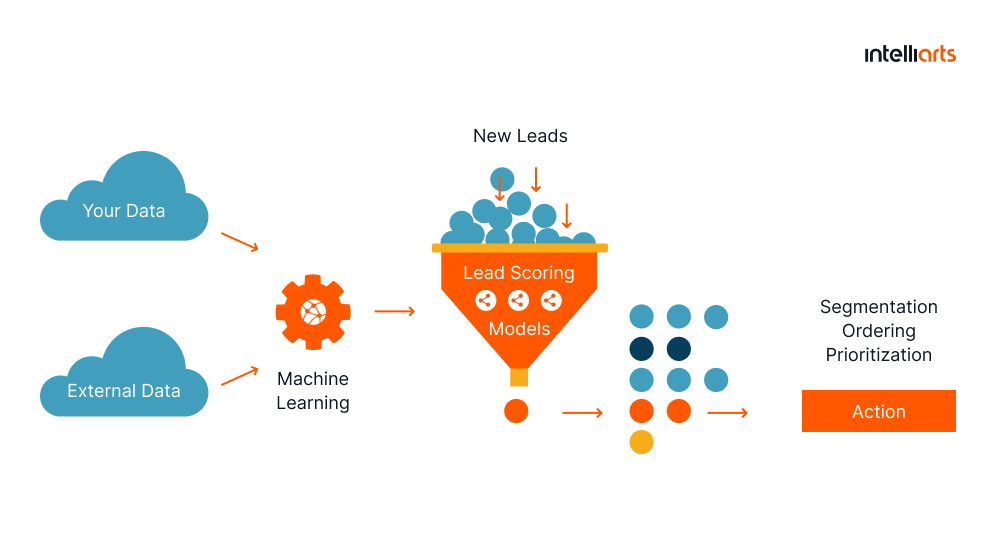

In the course of joint work with the customer, Intelliarts created a predictive lead scoring model able to forecast how likely the lead would buy a policy. With this system in place, agents could call leads with high scores first and leave leads with a low probability of sales success for later or skip them entirely to save resources and reduce costs.

Business Value Delivered:

- Machine learning predictive lead scoring model that we built allowed the customer to cut off approximately 6% of non-efficient leads, which resulted in a 1.5% increase in profit in a few months.

- Now the insurer groups leads by the probability of sales success. The group with an 80% probability and more has an expected conversion rate 3.5 times bigger than the average conversion.

- The company raised their efficiency, optimized company resources, and removed any guesswork from lead scoring.

ML Development, Data Analysis, Data Science

The workflow was effective. Intelliarts was always available and met with us regularly to discuss progress.

VP of Product Management

Technology Solution

Although the project is ongoing, and we continue to improve the model’s predictive power and add new features, here are the key milestones of how we engineered the predictive lead scoring solution:

- Our team of data scientists kicked off work on the project with data collection. By enlisting the support of the insurance company, we gathered information about lead sources, customer behaviors, quotes, demographics, property data, and contact data.

- In modeling, we chose gradient boosting techniques to recognize patterns in data. These were the most appropriate to use with tabular data, data with lots of categorical features, and a binary target (sold vs. not sold).

- At this stage, we had to handle a range of data problems, among which the missing data and different historical factors. We solved this by building a Python module with several code blocks, such as those related to extracting useful features from text and time data; cleaning data and replacing the missing values; cleaning anomalies and outliers in data to exclude some impossible values, e.g. negative age, etc.

- Aside from addressing the data challenges we met, this approach allowed us to discover multiple insights about the insurer’s data. Eventually, our data engineers used these insights to improve the data collection logic and strengthen the predictive lead scoring system design.

- We replicated the model results to build the same solution for prospect prediction. After all, the scoring solution became more complex as the customer ranked the potential buyers in two phases (as leads and prospects).

- To boost lead efficiency, we built one more ML model to predict the score continuous number. We calculated the score as the number of policies bought by a single lead divided by the call time spent on this lead.

- This was a traditional regression task in ML, which was complicated with lots of messy data related to call duration. To improve the accuracy of prediction results, we used the same Python module for data cleaning.

- Using Amazon SageMaker, our data engineers deployed the models and integrated the solutions into the customer’s system to establish connectivity and help the insurer avoid any system integration challenges.

Business Outcomes

As the customer wanted to optimize their lead-scoring workflow, Intelliarts helped the company build a predictive lead-scoring model that could forecast the probability of sales success. By the end of the project:

- We built a workable ML-powered scoring model with over 90% accuracy and good results in production.

After a few months, the scoring prediction model helped the insurer increase their profit by 1.5% by cutting off at least 6% of leads. - In the most successful months, the customer noticed a 2.5% increase in profit.

- Now the customer uses a more data-driven approach to lead scoring solutions, which results in less guesswork and more accuracy when it comes to prioritizing leads.

- The quality of leads increased since the scoring model groups leads by the probability of sales success. The group with an 80% probability and more has an expected conversion rate 3.5 times bigger than the average conversion now.

- At the same time, agents don’t waste their time on the bottom group with 20% and less probability predicted by the model as these don’t bring much efficiency to the insurer. After all, this approach allowed the company to optimize costs and improve profitability.

- As it was a full-cycle ML project, we helped to integrate the solution with AI lead scoring into the customer’s system and are ready to fine-tune or retrain the models if needed.